Oct 1, 2020

A Single Trade Just Pulled Half a Billion Dollars From TIPS Fund

, Bloomberg News

(Bloomberg) -- The worst outflow in months from the world’s biggest inflation-focused bond ETF was likely the work of a single investor.

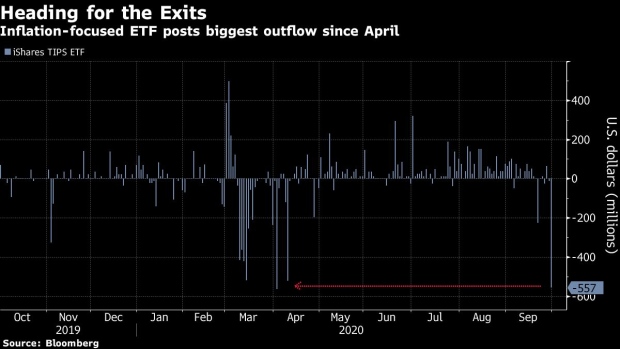

BlackRock Inc.’s $23.5 billion iShares TIPS exchange-traded fund, ticker TIP, saw over 4.4 million shares worth roughly $562 million hit the tape at 4:24 p.m. in New York on Wednesday, data compiled by Bloomberg show. Though it’s unclear if the trade -- the largest since April -- was to buy or sell shares of TIP, it lines up with the fund’s nearly $557 million outflow yesterday.

BlackRock, Bank of America Corp., FMR LLC and Morgan Stanley were the only firms with enough holdings in TIP to make a trade that size, the latest available data from June show.

The outflow, which is the second-largest this year for TIP, comes over as U.S. stimulus negotiations are stalled. That’s dampened inflation expectations, with five-year break-even rates posting their first monthly loss since March in September. That’s cooled a steady rally for inflation-linked products such as TIP.

The massive block trade could be the result of model portfolio rebalancing, according to Bloomberg Intelligence’s James Seyffart. Such activity is theorized to be driving a series of dramatic flows in recent months, including record rotations across a suite of Charles Schwab Corp. funds in a single week in June.

Merrill Lynch -- owned by Bank of America, one of TIP’s top holders -- is one of the biggest providers of the ready-made strategies. At the end of June, Bank of America was also the second-largest holder in BlackRock’s iShares 20+ Year Treasury Bond ETF, or TLT, which saw a $556 million inflow on Wednesday -- nearly identical to TIP’s outflow that day.

“This redemption and solo trade is so large that my guess is it was Merrill Lynch,” said Seyffart, an ETF analyst. “We often refer to them as ‘Big Foot’ in the market because you can see their footprints across the ETF markets every once in a while -- like this giant trade.”

©2020 Bloomberg L.P.