Feb 23, 2019

A Surprise China Debt Default Upends Assumptions on Official Aid

, Bloomberg News

(Bloomberg) -- A Chinese state-backed borrower’s failure to make good on a payment on a dollar bond on Friday threatens to overturn assumptions that officials would step in to avert defaults by companies closely linked to local authorities.

Qinghai Provincial Investment Group Co., an aluminum producer that was seen by some analysts as a bellwether for assessing government support due to its struggles to make payments on offshore debt last year, had failed to wire funds for a coupon payment due Feb. 22 as of late afternoon China time. That was according to an official at QPIG, as the issuer is known, who asked not to be named citing company policy. There is no grace period for a missed coupon on this note, according to the bond prospectus, suggesting it’s now in default.

As recently as mid-December, S&P Global Ratings had removed QPIG from CreditWatch with negative implications, concluding that it would “continue to receive ongoing government support and be able to meet its short-term financial obligations over the next 12 months, despite its weak liquidity.” S&P rated QPIG at B+, four steps below investment grade.

While discussions have been taking place to shore up QPIG, based in the western province of Qinghai, Friday’s failed payment indicates limits to officials’ appetite to aid borrowers with high leverage in industries with excess capacity. Though China’s national policy makers have unveiled a slew of measures to support economic growth in recent months, the Communist Party’s senior leadership reaffirmed at a Politburo meeting Friday that addressing financial risks remain a priority for 2019.

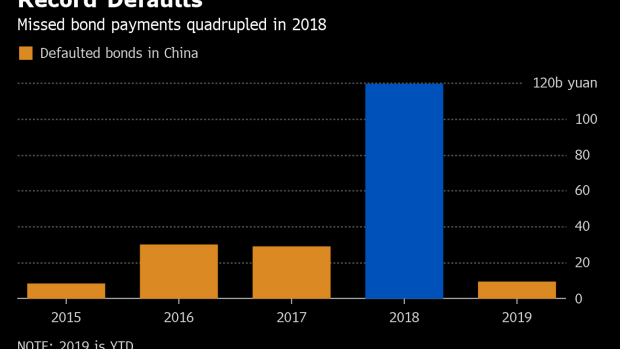

Read a QuickTake on China’s record pace of defaults.

Investors appeared to not have seen the coupon-payment failure coming, with prices on QPIG’s $300 million bond due in 2020 indicated around 94 cents on the dollar before Bloomberg reported the news on Friday. Some analysts regard the company as a local government financing vehicle, and the apparent default may renew predictions for LGFV defaults that HSBC Holdings Plc analysts said just last month was unlikely in the short term.

Qinghai Provincial’s "missed payment will definitely rock sentiment on Chinese LGFVs because so far the government has been supporting the sector at all costs," said Owen Gallimore, head of credit strategy at Australia & New Zealand Banking Group. "An LGFV default will have dangerous systematic risk as it will encourage others to follow."

Without any regular source of dollar revenue, borrowers linked to local authorities were long viewed as potential candidates for default in the offshore market -- though up to now official support made the difference. Dollar bonds from LGFVs have typically been bought by Chinese investors, and sales picked up last fall after some stressed issuers, including QPIG, made good on their payments. The missed payment may now see investors reevaluate prices for a swathe of borrowers -- and particularly those from Qinghai.

“QPIG is the largest aluminum producer in Qinghai province,” and was more than two-thirds owned by the provincial government, S&P analysts wrote in its report in December. “Its credit standing is important for the government because a default could reverberate throughout the value chain, including the power and coal industries.”

In China’s onshore market, defaults quadrupled from 2017 to 2018, to a record 120 billion yuan ($18 billion). The vast majority of those have come from private enterprises, not state-backed ones. For foreign investors, who are increasingly pouring into China’s onshore market, the QPIG incident may underscore the risks of branching out beyond central government bonds and securities sold by three key so-called policy banks -- which together account for more than four-fifths of their current holdings.

--With assistance from Ina Zhou, Lianting Tu, Neha D'silva and Tongjian Dong.

To contact the reporters on this story: Christopher Anstey in Tokyo at canstey@bloomberg.net;Carrie Hong in Hong Kong at chong61@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Shamim Adam, Jeff Sutherland

©2019 Bloomberg L.P.