Jul 12, 2019

AB InBev Asia unit struggles to price Hong Kong IPO

, Bloomberg News

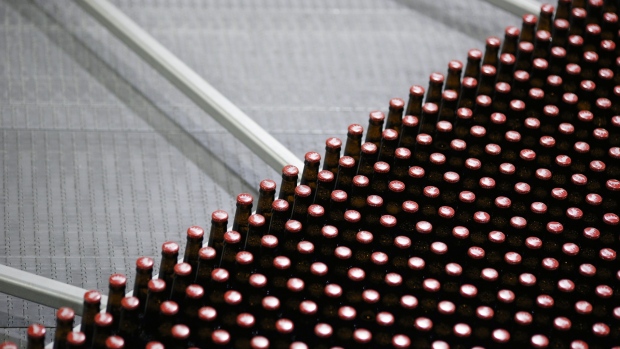

Anheuser-Busch InBev NV’s Asia Pacific (BUD.N) unit is struggling to price a Hong Kong initial public offering that was seeking to raise as much as US$9.8 billion, people with knowledge of the matter said, potentially delaying a deal that was set to be the world’s biggest share sale this year.

Budweiser Brewing Company APAC Ltd., which was planning to price the share sale Friday in Hong Kong, is weighing options including relaunching the offering at a later date with different terms, according to the people. Deal arrangers reviewing investor orders have so far had difficulty finding enough demand to price it within the current range, the people said, asking not to be identified as the information is private.

The company will meet its advisers over the weekend to decide on the next steps, one of the people said. The brewer was offering 1.63 billion shares for HK$40 to HK$47 each, according to a prospectus.

Shares of AB InBev fell as much as 3.6 per cent in early trading Friday and were down 1.5 per cent at 10:41 a.m. in Brussels. A representative for AB InBev declined to comment. Reuters reported earlier that the company wouldn’t price its share sale Friday as planned, citing unidentified people.

Even at the bottom end of the marketed price range, Budweiser’s share sale would have been the biggest globally this year, trumping Uber Technologies Inc.’s US$8.1 billion deal, according to data compiled by Bloomberg.

Budweiser’s struggle to price comes after Swiss Re AG on Thursday suspended an IPO of ReAssure Group Plc which could have valued the unit at as much as 3.3 billion pounds ($4.1 billion), citing weak investor demand.

The brewer has no later than July 15 to price the offering, according to the prospectus. The company was scheduled to start trading in Hong Kong on July 19. JPMorgan Chase & Co. and Morgan Stanley are leading the offering.

--With assistance from Thomas Buckley.