Dec 4, 2019

Abe’s $239 Billion Stimulus Fails to Stir Japan’s Bond Market

, Bloomberg News

(Bloomberg) -- Traders in Japan’s bond market seem to be shrugging off Prime Minister Shinzo Abe’s multi-billion dollar bid to revive the economy.

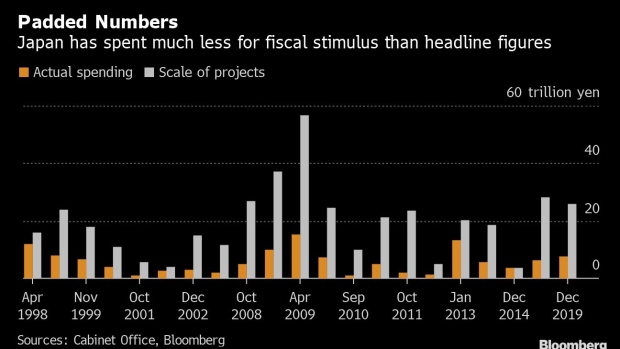

While Abe’s total stimulus package is worth about 26 trillion yen ($239 billion), headline figures for such announcements in Japan are typically inflated with promised loans and private-sector assistance. Details of the plan show it entails actual central government spending of just 7.6 trillion yen, which analysts say is too small to move the needle for the markets.

“Given it’s not a number that can boost economic growth and push up inflation to 2%, the impact over the bond market will be limited,” said Toru Suehiro, senior economist at Mizuho Securities Co. in Tokyo. “Considering the actual outlay, next year will just be slightly better than this year for the economy.”

Japan’s bonds hardly budged as the stimulus details were announced Thursday, largely holding on to the early losses they suffered in the wake of Wednesday’s sell-off in Treasuries. The benchmark 10-year yield was up 1.5 basis points at minus 0.025%.

The nation’s yield curve has shifted to its flattest level in three months even amid heightened speculation around the planned fiscal boost. That suggests there was little concern among bond investors that any package from Abe would lift inflation or prompt the Bank of Japan to pare its monetary stimulus.

To contact the reporter on this story: Masaki Kondo in Tokyo at mkondo3@bloomberg.net

To contact the editors responsible for this story: Tan Hwee Ann at hatan@bloomberg.net, Shikhar Balwani, Brett Miller

©2019 Bloomberg L.P.