Jun 18, 2021

Abiy’s Crackdown Takes Toll on Ethiopia’s Once-Thriving Economy

, Bloomberg News

(Bloomberg) -- Three years after heralding an end to authoritarian rule and plans to open up Ethiopia’s economy to foreign businesses, Prime Minister Abiy Ahmed is alienating allies and frightening off investors.

Reforms the once-feted Nobel Peace Prize laureate began implementing in 2018 have sparked ethnic clashes and a civil war in its northern Tigray region that has spawned a famine. His failure to end the violence has drained state finances and drawn sanctions from the U.S. and elsewhere that may undermine plans to restructure the nation’s debt.

Despite the morass, Abiy is a shoo-in to win his first electoral test when Ethiopians vote on June 21, thanks to widespread domestic backing and a fragmented opposition. What he does with that mandate, including how he responds to calls for a national dialog to heal widening political divisions, will determine the success of his reform project.

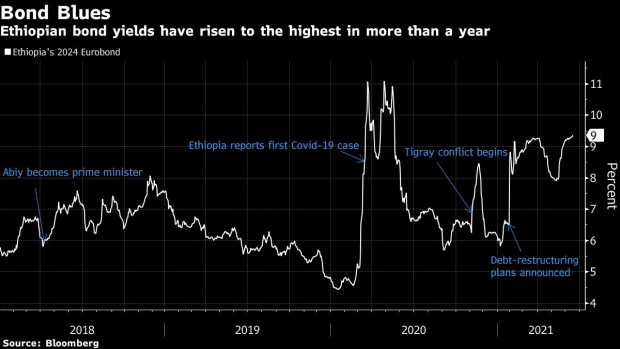

Holders of the nation’s $1 billion of Eurobonds aren’t optimistic: Yields on the 2024 debt are at the highest level in more than a year after rising consistently for the past month. Its currency has slumped 11% against the dollar this year -- the worst performer among 20 African currencies monitored by Bloomberg.

“The shine has come off the star in a big way,” said Kevin Daly, investment director at Aberdeen Standard Investments, which sold off its Ethiopian bonds last year on concerns the country may renegotiate its debt -- a step the government announced at the start of 2021. “Conflict and sanctions are pilling up pressure on the country.”

Ethiopia has been beset by unrest since Abiy’s unbanning of opposition and rebel groups stoked political fragmentation and long-suppressed rivalries among rival ethnic groups. Hundreds of people have died in inter-communal fighting in the Amhara, Oromia and Benishangul-Gumuz regions.

War erupted in Tigray in November, when Abiy ordered a military incursion after forces loyal to the region’s dissident ruling party attacked a federal army base. Since then, reports of Ethiopian troops and forces from neighboring Eritrea committing human-rights abuses in Tigray have been rife and relief agencies say the authorities are hampering efforts to deliver humanitarian aid.

The 44-year-old prime minister has remained unrepentant, accusing the Tigrayans of waging an insurrection and Western powers of meddling in his nation’s internal affairs. U.S. President Joe Biden’s administration last month imposed wide-ranging sanctions on Ethiopia and urged the International Monetary Fund, World Bank and other multilateral lenders to halt their engagement with Ethiopia.

A block on their funding could derail an IMF loan program needed to rework foreign obligations under the Group of 20 leading economies’ so-called Common Framework plan, which enables poor countries in debt distress due to the coronavirus pandemic to avoid default. Ethiopia is the biggest economy yet to seek relief under the initiative.

‘IMF Program’

“Common Framework restructuring is subject to an IMF program,” said Pavel Mamai, a fund manager at London-based Promeritum Investment Management LLP, which holds Ethiopian debt. “So no IMF, no Common Framework.”

The U.S. government has warned more stringent sanctions may be imposed unless the violence in Tigray ends.

Members of Abiy’s administration say they’re committed to rebuilding ties with the U.S. and hired lobbying firms in Washington D.C. to aid their efforts. Ethiopian State Minister for Finance and veteran diplomat Tekeda Alemu led a delegation to Washington this month to try and get the sanctions reversed and fend off any additional censure, according to people familiar with the trip.

“We are talking,” said Dina Mufti, a spokesman for the foreign ministry. Ethiopia has “many friends in the U.S., in civil society and in Congress,” he said.

Investment Slows

Ethiopia is one of the world’s biggest recipients of U.S. aid, receiving $1 billion last year. The threat of withdrawal of that funding coincides with a decline in foreign direct investment -- inflows slowed to $2.41 billion last year, from a high of $4.17 billion in 2017, data from the Ethiopian Investment Commission shows.

With about 110 million people, second only to Nigeria in Africa, and the government continuing to push ahead with economic reforms, some investors still consider the nation a prize market. Last month, a new telecommunications license was awarded to a consortium that includes the U.K.’s Vodafone Group Plc and Nairobi-based Safaricom Ltd. and which intends to invest $8.5 billion in its network over the next decade.

Anders Faergemann, a money manager at PineBridge Investments in London, is among those who see the hammering Ethiopian markets have taken as excessive.

“If you compare it to Zambia, which is going through restructuring, Ethiopia has multilateral backing and sufficient foreign exchange reserves to service their debt,” Faergemann said. “It seems the authorities’ talk about debt profiling has been blown out of proportion and there is still a premium that is unjustified.”

Opponents Jailed

International scrutiny will now turn to how Abiy handles this week’s election. The credibility of the vote is already in dispute, with most of his key opponents and thousands of their supporters having been jailed. The African Union will be the only major international organization to field an observer mission, with the European Union having pulled out.

While the chairwoman of the National Election Board of Ethiopia -- former opposition leader Birtukan Mideksa -- is widely respected, the U.S.’s National Democratic Institute and the International Republican Institute have raised concerns that logistical arrangements may not be completed in time and insecurity may compromise the election’s integrity.

Even though Ethiopia’s debt ratios aren’t “super high,” it remains in a difficult position, said Sarah Baynton-Glen, a London-based economist at Standard Chartered Bank. It is simultaneously confronting political unrest, the Tigray crisis, the suspension of aid and a chronic foreign exchange liquidity issues “none of which has a quick solution,” she said.

©2021 Bloomberg L.P.