Dec 22, 2022

Abrdn CFO Bruce to Leave After Turbulent Period at Asset Manager

, Bloomberg News

(Bloomberg) -- The chief financial officer of abrdn plc is planning to leave in the coming months after a turbulent period at the asset manager and a drive to improve returns.

Stephanie Bruce, one of the UK’s most high-profile women in finance who has been chief financial officer of abrdn since June 2019, is stepping down. The Edinburgh-based firm is searching for a replacement.

A spokesman for abrdn confirmed the planned change.

“Stephanie initiated a conversation earlier in 2022,” the spokesperson said. “We are actively recruiting a replacement for her. There will be a smooth and orderly transition.”

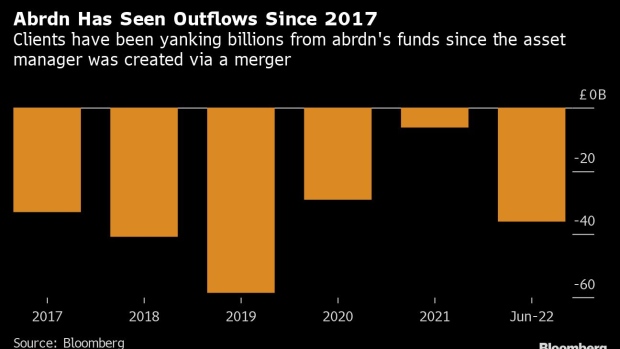

Bruce leaves after a period of change under Chief Executive Officer Stephen Bird, who has been trying to stem fund outflows. Changes have included a rebranding from Standard Life Aberdeen to abrdn and the acquisition of platform Interactive Investor to drive digital sales.

In the six months through June abrdn reported outflows of £35.9 billion ($43.2 billion), dragging assets under management and administration to £508 billion from £542 billion. The vast majority of the outflows was down to Lloyds pulling £24.4 billion of cash from a mandate that the asset manager lost in the wake of its merger in 2017.

Bird has also been restructuring the asset management arm of the business, trying to refocus on specific areas and merging around 100 funds that ran a combined £7 billion.

Bruce joined in 2019 from accountancy firm PwC, where she was a partner. At the same time, Chairman Douglas Flint restructured the board, ditching its unusual co-chief executive structure, putting Keith Skeoch, who had previously shared the role with Martin Gilbert, in sole charge.

The firm was created via the 2017 merger of two Scottish financial institutions, Standard Life and Aberdeen Asset Management, run respectively by Skeoch and Gilbert. The deal was a response to increasing competition from low-cost passive asset managers such as BlackRock Inc. and Vanguard Group.

--With assistance from Tom Metcalf.

(Updates with outflows in the sixth paragraph)

©2022 Bloomberg L.P.