Jan 31, 2023

Activist Elliott Discloses Stake in Germany’s Vantage Towers

, Bloomberg News

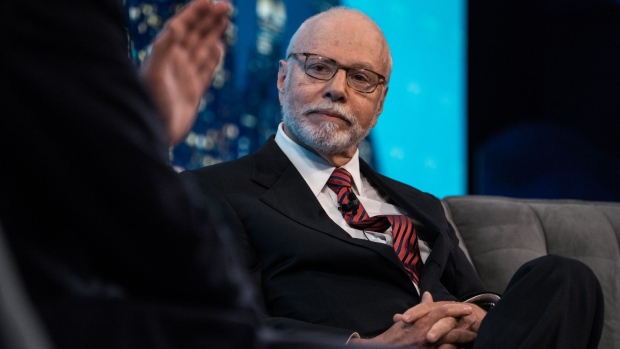

(Bloomberg) -- Elliott Investment Management, the activist investor owned by billionaire Paul Singer, disclosed a stake in Germany’s Vantage Towers AG as the tower company’s controlling shareholders work to take the business private.

The investor said it owns 5.6% of the company’s total voting rights as of Jan. 24, in a regulatory filing released on Tuesday.

Read More: Vodafone Sells Stake in $16 Billion Tower Arm to KKR, GIP

Elliott could use the stake to take advantage of a German law that lets investors, under certain conditions, challenge a bidder for a higher offer. The activist used the rule in Vodafone Group Plc’s deal for Kabel Deutschland Holding AG, building a stake in the target and claiming the telecom carrier had underpaid. The conflict dragged on for seven years, and Vodafone ultimately paid out.

Vantage shares jumped to a record high of €33.68 apiece after the statement, above the €32-per-share bid price that Vantage’s minority investors were offered to sell their stakes.

A spokeswoman for Vantage Towers confirmed Elliott’s stake and declined to comment further. A representative for Elliott declined to comment.

Last year, Vodafone transferred its 81.7% stake in Vantage into a new venture, led by private equity firms KKR & Co. and Global Infrastructure Partners, in a deal that saw Vodafone sell part of its holding to the buyout companies.

The new venture then made an offer for the remaining shares in Vantage in a tender that ended this month. The results haven’t yet been announced.

Read More: Vantage Soars Above KKR, GIP Offer on Possible Higher Bid

German law allows a bidder that gets 75% of shares of a target company to implement a “domination profit and loss transfer agreement,” which lets it take control of the company without owning all of its shares. That agreement gives the majority holder control over the strategy and access to a company’s profits in return for paying minority shareholders a dividend.

But investors who haven’t sold their stock can lobby for a better offer or sue for a higher price from the courts.

If the bidder gets control of 95% of Vantage’s shares, it can “squeeze out” the minority holders, forcing them to sell their shares.

--With assistance from Swetha Gopinath.

(Updates with additional context throughout)

©2023 Bloomberg L.P.