Jan 25, 2022

Activist Investor Cevian Attacks Ericsson With List of Demands

, Bloomberg News

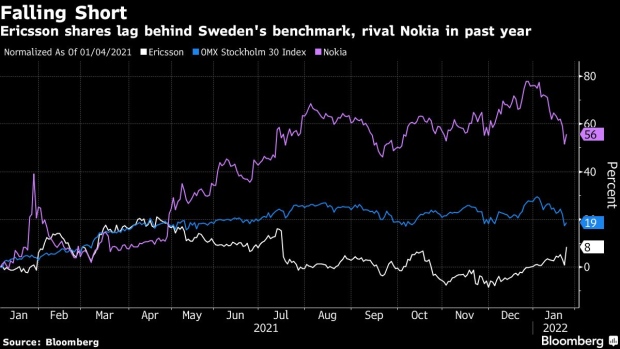

(Bloomberg) -- Ericsson AB shares jumped the most in almost a year after a set of stellar earnings. It wasn’t enough to impress activist investor Cevian Capital AB.

The telecom firm posted fourth-quarter results that beat analyst estimates on Tuesday. However, the “very strong” earnings do little to address undervaluation in Ericsson’s stock, said Christer Gardell, managing partner at Cevian, stepping up his critique of the technology company.

Gardell on Tuesday set out a list of demands he said management and the board need to deliver on, touching all parts of the business, excluding the Networks business.

Among the most scathing comments, Gardell told Ericsson to make a “massive improvement to the company’s communication -- no more screw-ups leading to unwarranted share price declines,” according to emailed comments.

He said the Swedish company needs to stem losses in its Digital Services unit, consider divesting it or spinning out its Managed Services business, and to clearly articulate the potential in its Enterprise business, including how and when it plans to get there.

Ericsson’s board and management should also “justify” to the market why it was better to use almost 60 billion kronor to make its biggest ever acquisition for Vonage Holdings Corp. at a price tag of “more than 50x EV/EBIT instead of buying back Ericsson shares at ~8x EV/EBIT,” Gardell added.

“The market clearly undervalues Ericsson’s leading market position in the growing 5G market and has not yet fully understood the opportunity in Enterprise,” said Gardell. Cevian is a top-three shareholder in Ericsson.

Ericsson’s press office didn’t immediately respond when asked for a comment.

Ericsson reported fourth-quarter adjusted operating profit of 12.3 billion Swedish kronor ($1.3 billion), beating the average analyst estimate of 10 billion kronor.

The boost came despite a drop in sales in China, which was offset by demand for upgrades to 5G in the rest of the world. Ericsson also an Ebit margin target for 2022 one year early.

Last year, Cevian called on Ericsson to increase payouts to shareholders and to lift the Swedish network equipment provider’s “ridiculously low” margin target.

(Adding chart, comments, sixth paragraph.)

©2022 Bloomberg L.P.