Apr 2, 2020

Adam Neumann Ousted From Billionaire Ranks on SoftBank Reversal

, Bloomberg News

(Bloomberg) -- WeWork co-founder Adam Neumann has a new title: ex-billionaire.

SoftBank Group Corp.’s decision to scrap an October agreement to buy $3 billion of WeWork stock means the former chief executive officer’s fortune has plummeted 97% to $450 million in less than a year -- wiping away $13.5 billion of his estimated net worth, according to the Bloomberg Billionaires Index.

Because the deal collapsed, Neumann won’t be able to sell as much as $970 million of stock in the co-working company. The agreement had already drawn scrutiny even before the coronavirus pandemic routed markets and reshaped the global economy.

While SoftBank’s decision leaves Neumann with a larger chunk of the firm he helped found a decade ago, those shares are likely worth less than SoftBank had offered for them. WeWork set a strike price of $4.12 for employee stock options in November, far lower than the $19.19 SoftBank was set to pay as part of the rescue.

Asher Gold, a spokesman for Neumann, declined to comment.

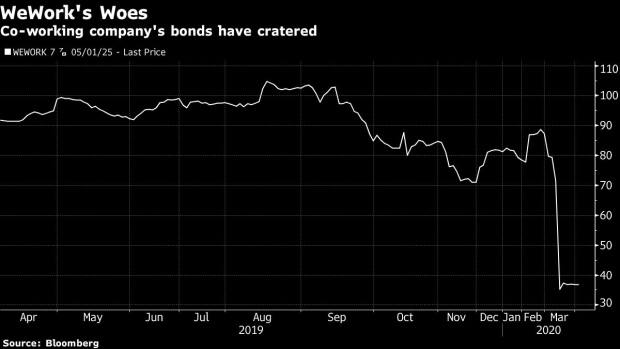

The coronavirus pandemic has brought major economies to a standstill, devastating co-working companies. WeWork’s locations stand practically empty as tenants stay home. Its bonds trade at less than 40 cents on the dollar and are yielding 36%. Shares of rival IWG Plc plunged 60% in the first quarter.

Neumann, 40, already had billions erased from his fortune last year, at least on paper, as WeWork’s private market valuation collapsed. His net worth rose to $14 billion last year before dropping to $1.3 billion at the time of SoftBank’s bailout, according to Bloomberg’s wealth ranking.

A special committee of WeWork’s board said in an emailed statement that it “will evaluate all of its legal options, including litigation,” against the Japanese conglomerate.

The fortune of SoftBank CEO Masayoshi Son is also under strain. Shares of SoftBank have dropped 21% this year, paring his net worth to about $12 billion, as investors fret about the company’s debt pile. About 40% of Son’s shares are pledged as collateral, according to regulatory filings.

©2020 Bloomberg L.P.