Jan 31, 2023

Adani Group Pledges More Shares of Ports Unit Amid Stock Rout

, Bloomberg News

(Bloomberg) -- The Adani Group pledged more shares of its ports arm to lenders, reflecting the growing spotlight on the conglomerate’s liquidity amid a short seller attack that has wiped out $69 billion from the market value of Gautam Adani’s empire.

Flourishing Trade and Investments Ltd. encumbered 2.69% more equity of Adani Ports & Special Economic Zone Ltd. to Catalyst Trusteeship Ltd., according to an exchange filing Tuesday. Catalyst, which is acting as a security trustee on behalf of lenders, now holds 7.79% shares of the port operator under pledge, it said.

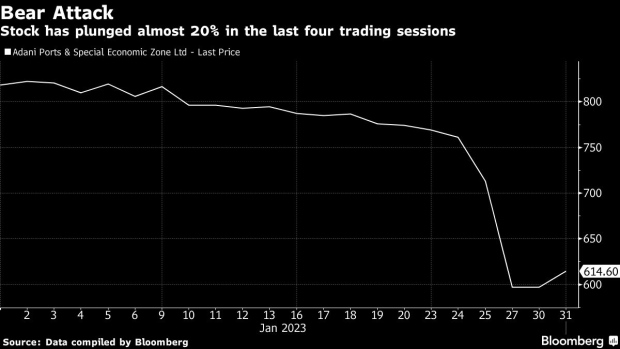

Adani Ports, India’s largest private-sector port operator with a 30% market share, has fallen over 19% in the past few trading sessions since US-based Hindenburg Research’s scathing report last week. The short seller accused the Adani conglomerate of “brazen” stock manipulation and accounting fraud — allegations that the group rebutted in a 413-page response but couldn’t stem the stock rout.

Read: Adani Pulls Off Share Sale After Jump In Final Bids

The additional pledge comes at a time when the tycoon’s flagship Adani Enterprises Ltd. concluded a follow-on share sale. It has attempted to boost investor confidence despite Hindenburg’s allegations that include Adani Group operating a web of companies in tax havens.

Billionaire Adani, who started as a diamond trader in Mumbai in the 1980s, now helms a conglomerate spanning ports, airports, coals mines, power plants and has more recently diversified into in renewables, cement, realty and media.

--With assistance from Anirban Nag.

(updates with latest number in second paragraph.)

©2023 Bloomberg L.P.