May 11, 2022

Adjustable Loans Form Largest Share of US Mortgages Since 2008

, Bloomberg News

(Bloomberg) -- US homebuyers are increasingly turning to adjustable-rate mortgages as overall borrowing costs soar.

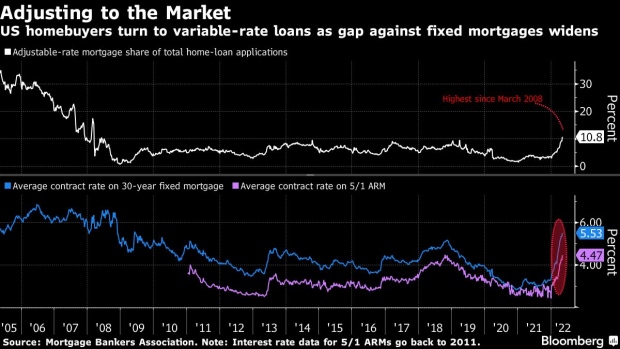

ARMs -- which carry variable interest rates that reset based on the market at predetermined times -- accounted for 10.8% of total home-loan applications in the week ended May 6, data from the Mortgage Bankers Association showed Wednesday. That’s up from 3.1% of activity at the start of the year and is the largest share since 2008.

Loan costs have increased steeply amid Federal Reserve actions to tame the worst bout of inflation in 40 years. The average contract interest for 30-year fixed-rate mortgages rose last week to a nearly 13-year high of 5.53%, MBA data show.

That’s made 5/1 ARMs, averaging 4.47%, look comparatively cheap for borrowers trying to lower their monthly payments. Such mortgages have a fixed interest rate for the first five years before resetting annually for the remaining life of the loan. Borrowers risk the potential of higher payments in the future in return for lower introductory rates.

“More borrowers continue to utilize ARMs to combat higher rates,” Joel Kan, MBA’s associate vice president of Economic and Industry Forecasting, said in a statement.

The ARM share of total applications peaked in March 2005 at 36.6% -- during the housing bubble that would pop soon thereafter -- but has held in the single digits in recent years as borrowers have sought to lock in historically low rates.

©2022 Bloomberg L.P.