Mar 31, 2023

African Rate Hikes Beat Forecasts as Inflation Worries Linger

, Bloomberg News

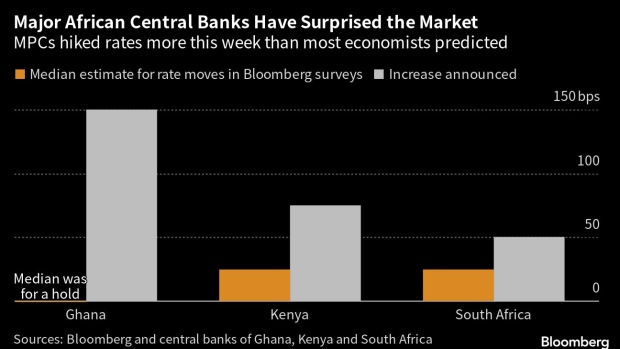

(Bloomberg) -- Three major African major central banks surprised financial markets this week by raising interest rates more than expected in an attempt to cool inflation.

Monetary policy committees in Ghana, Kenya and South Africa announced hikes that beat the predictions of all economists in Bloomberg surveys.

The moves follow the Federal Reserve’s 25-basis point hike last week, with the US statement saying the Federal Open Market Committee anticipates that some additional policy firming may be appropriate.

“If the Fed is hiking, emerging markets remain under pressure and need to continue to try and narrow that real interest rate differential so that they can get some flows, which would alleviate some pressure on the currencies,” said Mpho Molopyane, an economist at Absa Group Ltd.

While price growth in the three African markets seems to have peaked, the central banks flagged risks.

At 52.8%, Ghana’s inflation is well above the target band of 6% to 10% and is only projected to ease to 29% by year-end, Governor Ernest Addison said. The pace of price growth in Kenya is also still above target and is expected to remain elevated in the near term, according to the MPC. In South Africa, policymakers lifted the forecast for average inflation this year to 6% from 5.4% and warned of upside risks to the outlook.

The bigger-than-expected hikes in Ghana and Kenya are a move back toward orthodoxy, said Razia Khan, chief economist for Africa and the Middle East at Standard Chartered Plc.

The debt-laden West African nation’s tilt back to more traditional policy is likely in anticipation of it receiving a support package from the International Monetary Fund while Kenya’s hawkish turn is probably linked to efforts to improve the functioning of its interbank foreign-exchange market and provide a safeguard against additional currency weakness, she said.

Kenya’s shilling has weakened almost 7% against the dollar this year.

The South African Reserve Bank was “reacting to the threat posed by elevated inflation expectations — sending a clear message that it wanted to manage this down — and that it stood ready to do what it takes to reinforce its anti-inflation credentials,” Khan said, referring to it as the region’s most credible central bank.

While South Africa’s MPC prefers to anchor expectations close to the 4.5% mid-point of its target range, a survey published before the rate decision showed analysts, labor groups and households expect inflation to average 6.3% this year.

©2023 Bloomberg L.P.