Jun 13, 2018

After Time Warner Win, AT&T Faces Bigger Hurdle: Fixing Pay TV

, Bloomberg News

(Bloomberg) -- AT&T Inc. prevailed in its grueling fight with the Justice Department on Tuesday, finally clearing the way for its 2016 Time Warner Inc. deal to take effect.

Now the telecom giant faces an even bigger challenge: reviving a declining TV business.

AT&T Chief Executive Officer Randall Stephenson looks to use his new role as a media baron to roll out new services, offer lower prices and create new bundles of entertainment. But reversing the slide of pay TV is no easy task. The major cable and satellite companies have been hemorrhaging traditional customers, with cord-cutters signing up instead for Netflix Inc. and other services.

And though pay-TV providers have been picking up some users with their own online-TV packages, those products don’t bring in as much revenue.

But AT&T has a secret weapon. In addition to the entertainment assets it’s gaining from the Time Warner takeover, which is slated to close by next week, the company is betting that more and more customers are going to be watching their TV on mobile devices -- AT&T’s strength. Imagine, for instance, enticing subscribers with phone-friendly versions of “Game of Thrones.”

“Randall Stephenson will try to pivot the video business to mobile as a way to fight against Netflix and the others,” said Amy Yong, an analyst with Macquarie Capital USA Inc.

The World Changed

It took about 20 months to get the $85.4 billion Time Warner takeover to the brink of completion. In that time, Netflix became the highest-valued U.S. media company and traditional entertainment icons -- including 21st Century Fox Inc. and Walt Disney Co. -- made their own deals to realign assets.

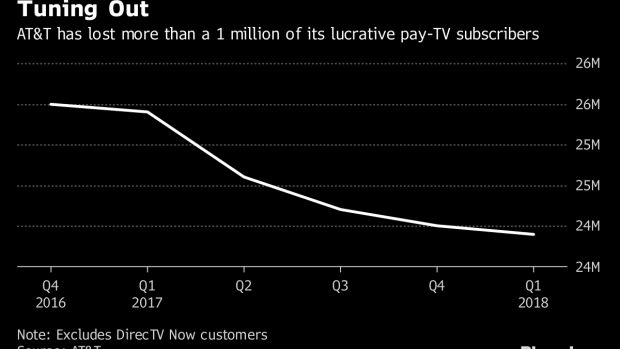

The delay also has taken a toll on AT&T. The company, which operates DirecTV and ranks as the largest pay-TV provider, saw more than 1 million lucrative video subscribers head out the door. Many have fled for Netflix, Hulu LLC and other streaming rivals, opting to cobble together a few services rather than paying for a costly satellite-TV package.

The question now is whether Stephenson, 58, can use Time Warner to win back customers. By owning both media assets and the means of distribution, Stephenson aims to replicate the capabilities of Comcast Corp., which acquired NBC Universal in 2011.

‘More Leeway’

The deal brings top-flight TV programming from HBO and Turner Broadcasting -- along with the legendary movie studio Warner Bros. -- and combines them with a telecom business that dates back to Alexander Graham Bell.

The victory over the Justice Department also gives Stephenson more confidence to execute his plans, said Roger Entner, an analyst with Recon Analytics LLC.

“The bigger AT&T wins, the more leeway Randall gets,” he said. “Courts and regulators often limit the way companies can act, including how they can innovate.’’

The first step is to stop the erosion of subscribers fleeing DirecTV to cheaper video services. Once the deal is closed, AT&T plans to roll out a new offering called Watch -- a $15-a-month, sports-free online TV package. Watch is $5 less than Dish Network Corp.’s $20 Sling TV and could serve as a promotional freebie for customers who sign up for unlimited wireless data plans.

Wireless Strength

AT&T is the second-largest wireless carrier -- behind Verizon Communications Inc. -- and a leader in cross-selling and bundling of services. The company is expected to offer a wider array of discounts to customers that buy two or more of its services.

Structurally, the merger will complete the split of AT&T into two main parts. The services businesses like wireless and TV will continue to be based in Dallas and run by John Donovan. Time Warner will become AT&T’s media division, which will be based in New York and Los Angeles. It will be headed by John Stankey.

The approach is meant to help insulate the creative showbiz culture from the traditional phone-company bureaucracy, where profit margins determine budgets and service is measured to 99.999 percent reliability.

Stankey, a phone-company lifer, has been acclimating himself to Hollywood by adding more shows and movies to his steady diet of sports viewing, he has said.

Cultural Shift

It’s a radical attempt to bridge two very different worlds, says Jennifer Fritzsche, an analyst with Wells Fargo & Co.

“There’s always a risk to transforming yourself,” she said. “AT&T is going from a very Texas/Republican-leaning company to a company with headquarters in New York City, Hollywood and Dallas. It will be interesting to see how they manage that.”

The challenge of making the merger successful will ride largely on AT&T’s marketing. The company will control CNN, HBO and Turner TV channels, which could make for compelling offers if combined with a wireless subscriptions and unlimited data plans.

Stephenson has even talked in the past about curating content for mobile customers. He envisions a way to cut popular shows like “Game of Thrones” into smaller bites to watch on the go. As YouTube, Snapchat and Instagram have shown, mobile customers often prefer shows that aren’t presented in an hourlong format.

With customers’ tastes changing so fast, AT&T also could benefit from a bit of good timing -- even after the lengthy legal battle.

“They could actually stumble into success,” said Kevin Roe, an analyst with Roe Equity Research LLC. “You never know.”

To contact the reporter on this story: Scott Moritz in New York at smoritz6@bloomberg.net

To contact the editor responsible for this story: Nick Turner at nturner7@bloomberg.net

©2018 Bloomberg L.P.