May 29, 2023

AI, active or passive: Larry Berman on the right approach for your portfolio

By Larry Berman

One could argue that a passive index approach to markets makes the most sense. One could argue that an active approach to security selection is needed to perform better than the index. One could also argue what the best index is to use.

We argue that active asset allocation (types and styles of exposure) can add value to your portfolio. Market timing is not easy, but research shows that adjusting the exposure by rebalancing and you can add longer-term value.

There are many factors to consider, these are some of the major ones:

- Tax situation

- Cost of transactions

- Goal of assets (time frame and use)

- Your ability to handle price volatility

Last week, we made an active trade using passive indexes overtly making a conscious bet on what type of stocks will perform best looking forward. This is not market timing, this is thoughtful rebalancing exposure to take advantage of an extreme situation within our goals for the portfolio.

The debate between passive and active will likely continue forever. I believe that most portfolios will be run by artificial intelligence in the coming years. Today, very few, if any investment decisions are not computer assisted.

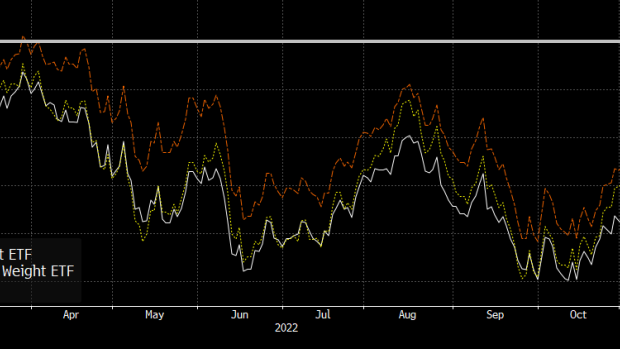

In 2022, the average stock did better than the market cap weighted stock (we are using the VTI Vanguard Total US Market ETF, which is the same as VUN that trades in Canada). Essentially, large cap technology was the major difference as was exposure to energy. For equal weight, we are using the Russell 1000 (EQAL) ETF and the Russell 2000 Index (there is no ETF that tracks this index anymore).

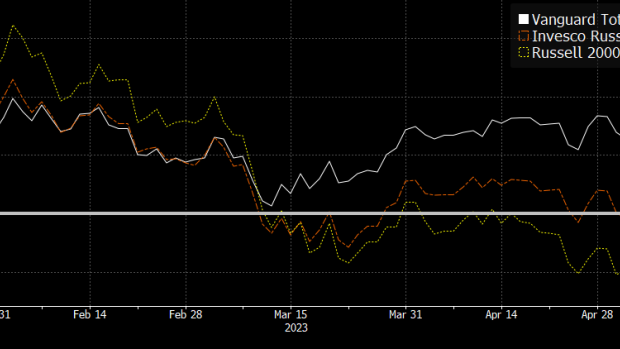

In 2023, it’s a very different picture. The average stock is down in 2023 as can be seen by the equal weight indexes compared to the market cap weighted indexes.

Last week we rebalanced by selling half our S&P 500 market cap weighted index (SPY) and bought the equal weight S&P 500 index (RSP). We have highlighted the rebalancing trades we did between these two passive indices since late 2021. These simple rebalancing trades added about five per cent to returns from Dec. 21 to May 22, a little more than one per cent on the two trades from May through October, and over six per cent from October 22 until last week. We relied on ChatGPT's advice based on principle two for the recent trade.

Thoughtful rebalancing of your portfolio can add value. It’s not about timing the market; it’s about what exposure makes the most sense from a risks versus rewards standpoint. This AI driven excitement driving a handful of stocks in 2023 could very well continue. As we saw, the average stock still beat the market cap weighted stock for months after we rebalanced in October 2022. This approach may be right for your registered accounts but may not be for your taxable accounts.

For your tax-free savings account, you may want to stick with the AI-led rally a while longer. Not all investment styles necessarily fit all portfolio types. For taxable accounts, an overweight to good Canadian dividend payers may make a lot of sense. On the other hand, if you do not need the current income and can handle the ride, maybe a Berkshire Hathaway that has no distribution to shareholders makes sense for long-term tax efficient growth.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com