Sep 29, 2017

Air Canada, rebound in oil prices headline TSX's positive Q3

The TSX Composite turned in a reasonably strong performance in the third quarter, helping push the benchmark index into positive territory after muddling through the first half of the year. Firming oil prices were a significant source of strength in the quarter, lending a hand to the more than three per cent return and making the TSX the 44th-best performing global stock index in Q3, sandwiched between the S&P 500 and Germany’s DAX Index.

Top performing sectors:

Energy: +5.97 per cent

Consumer Discretionary: +4.32 per cent

Financials: +3.98 per cent

A resurgence in crude oil prices helped drive the energy subgroup to the best performance over the course of the third quarter, mitigating some weakness in natural gas prices. Crude now sits firmly above US$50 per barrel as markets gain confidence in OPEC’s production cuts, though the benefit of higher prices for domestic producers is somewhat blunted by the stronger Canadian dollar. Consumer strength powered the discretionary sector higher in the quarter, and the financial services group posted a nearly four per cent increase as the Canadian banks shrugged off housing market concerns on their way to another solid quarter.

Worst performing sectors:

Health Care: -10.26 per cent

Utilities: -2.99 per cent

Consumer Staples: -2.92 per cent

The health care subgroup went from first in the second quarter to worst in Q3, though it by and large doesn’t move the needle for the overall index due to its paltry 0.6 per cent weighting. A pair of traditional yield plays did much more to drag on the index’s overall return, as normalizing interest rates helped take the wind out of the sails of the utilities group and consumer staples.

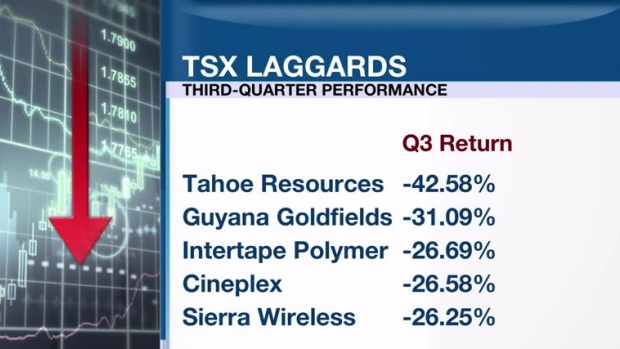

Oddly enough, not a single member of the worst-performing stock group belongs to any of the bottom three subgroups. The bottom five is something of a grab bag, with Tahoe Resources’ struggles in Guatemala slicing 40 per cent off the miner’s market cap. The central American government pulled the mining license for Tahoe’s Escobal operations due to allegations the miner failed to properly consult with indigenous groups. The license has since been reinstated, but the facility has been repeatedly blockaded by jilted workers. Guyana Goldfields, by contrast, ran into execution issues in the quarter, with poor ore grades and higher processing costs drove its all-in sustaining costs per ounce 33 per cent higher to US$1,144.

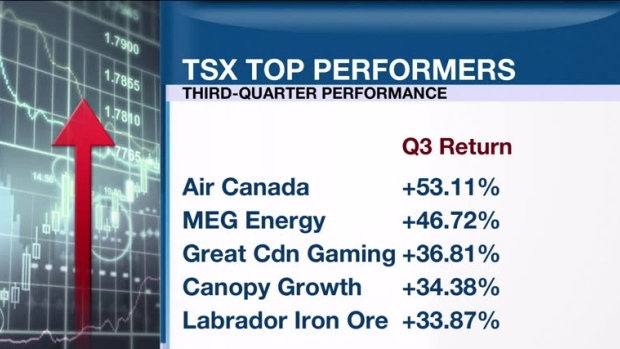

The nation’s largest air carrier headlines the TSX’s third quarter performance, delivering a sparkling 53 per cent return over just three months. Air Canada had no trouble surging past preciously-raised earnings expectations due to a 13.6 per cent jump in passenger traffic. MEG Energy’s high leverage to oil prices and updated outlook for lower operating costs per barrel helped push it to the number two slot. Great Canadian Gaming notched almost the entirety of its gains in a single trading session, after the company secured the right to operate the OLG Slots at Woodbine, OLG Slots at Ajax Downs and the Great Blue Heron Casino in the Greater Toronto Area.

Honourable mention:

Cenovus (CVE.TO): +30.75 per cent

While Cenovus wasn’t able to sneak into the top five, the oil sands player did manage to turn in the seventh best performance in the quarter after a dreadful start to the year. Shares had been punished in the wake of its much-criticized $17.7 billion deal for ConocoPhillips oil sands assets, but outgoing Chief Executive Officer Brian Ferguson is making headway in his quest to sell assets to raise as much as $5 billion dollars to chip away at the company’s debt, most recently its Suffield holdings.