Dec 31, 2021

Airbnb and DoorDash set for flurry of analyst coverage next week

, Bloomberg News

Airbnb Inc. and DoorDash Inc. are poised for a flurry of Wall Street research on Monday after the quiet period ends for analysts at banks that underwrote the companies’ initial public offerings earlier this month.

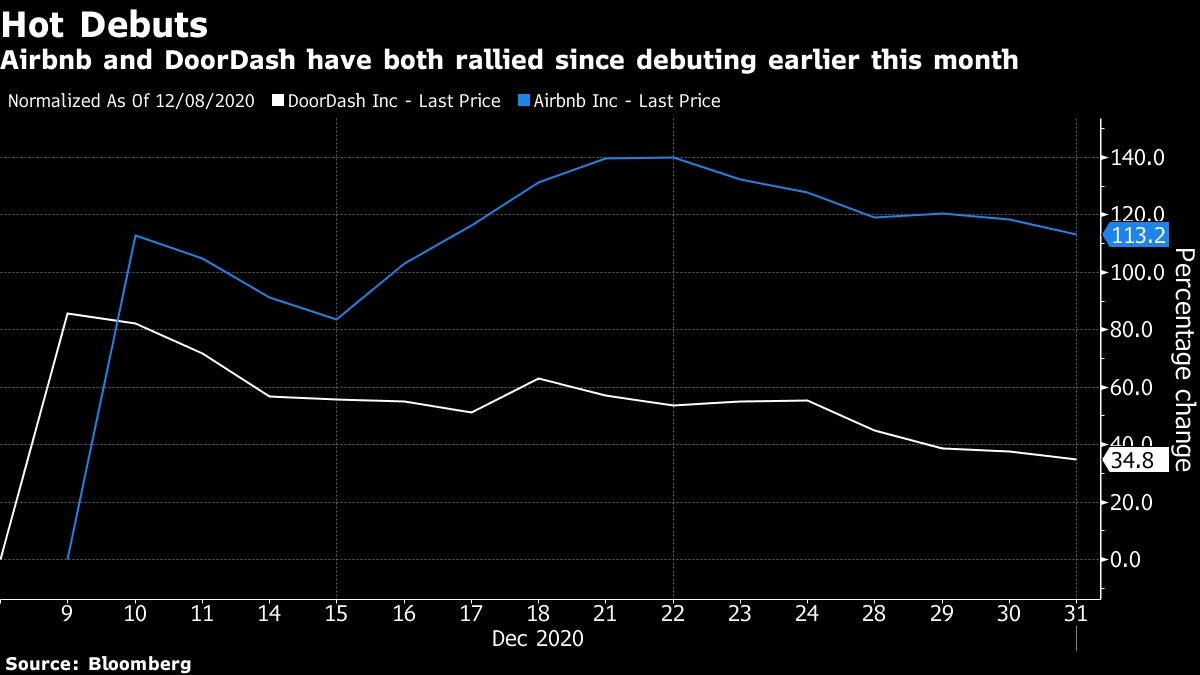

Valuation is likely to be a key focus for analysts. Both stocks soared in their market debuts after pricing above already raised offering ranges. Food-delivery company DoorDash has shed gains since rising 86 per cent in its first day of trading yet is still up 37 per cent since Dec. 8. The shares of Airbnb, which owns a platform for lodging rentals, have more than doubled since debuting on Dec. 9.

Of the seven analysts tracked by Bloomberg that currently cover Airbnb, four have buy ratings and two have sells. The stock is trading about 40 per cent above the average price target of US$103. DoorDash has 3 buy ratings and 3 holds and is trading just shy of the average price target of US$144, according to Bloomberg data.

DoorDash underwriters:

- Goldman Sachs, JPMorgan, Barclays, Deutsche Bank, RBC, UBS, Mizuho, JMP Securities, Needham, Oppenheimer, Piper Sandler and William Blair

Airbnb underwriters:

- Morgan Stanley, Goldman Sachs, Allen & Co., Bank of America, Barclays, Citigroup, BNP Paribas, Mizuho, Credit Suisse, Deutsche Bank, Jefferies, Wells Fargo, Baird, Canaccord Genuity, Cowen, D.A. Davidson, JMP Securities, KeyBanc, Needham, Oppenheimer, Piper Sandler, Raymond James, Stifel, Wedbush, William Blair, Academy Securities, Blaylock Van, CastleOak Securities, C.L. King, Guzman & Co., Loop Capital Markets, MFR Securities, Mischler Financial, Ramirez & Co., Siebert Williams Shank, Telsey Advisory and Tigress Financial