Aug 2, 2022

Airbnb slumps after bookings missed analyst estimates

, Bloomberg News

Bruce Murray discusses Airbnb Inc

Airbnb Inc. shares slid after the company missed estimates on bookings, highlighting investors’ and analysts’ high expectations for companies in the travel sector after a long COVID slump.

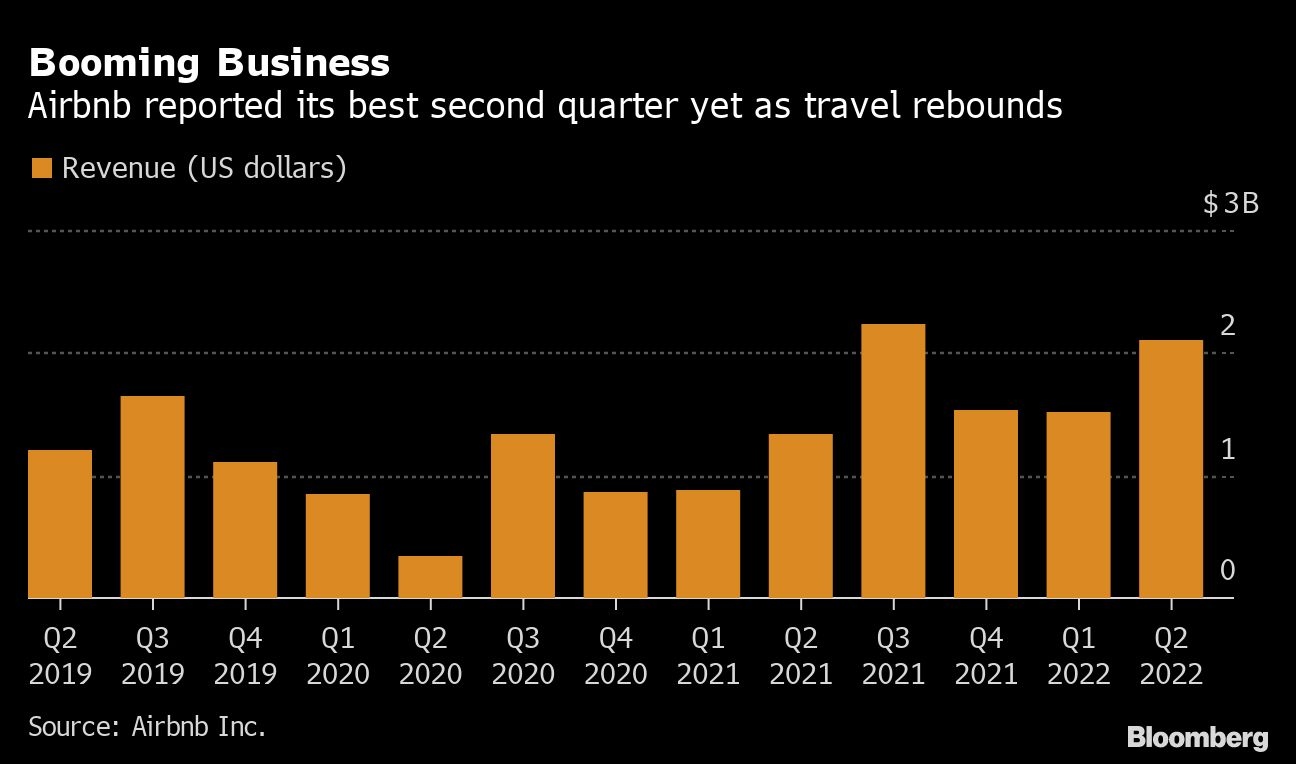

The San Francisco-based home-rental company said Tuesday that nights and experiences booked in the second quarter rose 25 per cent to 103.7 million, missing an analyst estimate of 106 million. The company is expecting similar growth in the third quarter, but that rate falls below analysts’ estimates of close to 109 million. Second-quarter sales rose 58 per cent from a year earlier to US$2.1 billion, matching the average projection.

Though Airbnb has been reporting a boom in activity from consumers demanding to get away, investors have been punishing the company, sending the stock down about 30 per cent this year. A US$2 billion buyback, its first ever, will offset dilution from an employee stock program. Though the company gave a forecast for a record third quarter, it has refused to use the windfall of demand to introduce a change of investment strategy amid the backdrop of a slowing world economy.

“During the height of the pandemic, we made many difficult choices to reduce our spending, making us a leaner and more focused company,” Airbnb said in a letter to shareholders. “We’ve kept this discipline ever since, allowing our hiring and investment plans to remain unchanged since the beginning of the year. Airbnb is well positioned for whatever lies ahead.”

The shares fell about 8 per cent in extended trading after closing at US$116.34 in New York. The stock has dropped 30 per cent this year.

Travel industry results in the current reporting period had started well after Visa Inc. said last week that cross-border transactions rose 28 per cent in the fiscal third quarter, beating analyst estimates. After Airbnb, Booking Holdings Inc. will report Wednesday and Expedia Group Inc. on Thursday. Both are also grappling with waning investor sentiment -- Booking is down 18 per cent this year, and Expedia has dropped about 43 per cent.

Airbnb Chief Executive Officer Brian Chesky and other industry executives have been expecting travel demand to surpass 2019 levels, overcoming strains from new COVID variants, an inflation pickup and Russia’s invasion of Ukraine. The platform has realized that expectation -- the US$379 million of net income is the highest ever for a second quarter.

Airbnb expects US$2.78 billion to US$2.88 billion of sales in the period ending in September, with the low end of that range matching the average in a Bloomberg survey of analysts. Airbnb recorded its highest-ever daily revenue on July 4, indicating demand continued in the current quarter.

The company reported earnings per share of 56 cents, a swing from last year’s 11 cent loss. The plan to buy back as much as US$2 billion of Class A stock allows transactions to be made at management’s discretion and through a variety of methods, including open market purchases, and can be terminated at any time.

Gross bookings, the total value of transactions on the platform, totaled US$17 billion in the second quarter, just topping the analyst estimate of US$16.9 billion. Long-term stays were the fastest growing category, gaining almost 90 per cent from three years ago, suggesting the pandemic boon is getting extended as people able to work from anywhere continue to seek longer-term stays in remote locations.

The enthusiasm for travel has given hosts pricing power, with daily rates averaging US$164 in the second quarter, 40 per cent more than three years ago. Airbnb expects a slight pickup in average daily rates on an annual basis in the third quarter to drive an increase in the value of gross bookings.

Airbnb said its expectation for a revenue pickup in the current quarter includes “a significant headwind from foreign exchange fluctuations relative to last year.” The strength of the greenback has been a theme for US tech giants, with Microsoft Corp. and Netflix Inc. among the companies reporting a hit to revenue. Roughly half of Airbnb’s sales comes from abroad, Booking does close to 90 per cent of its business overseas, and Expedia’s share is around 25 per cent. Investors have worried about slowing economic growth, but Airbnb executives are confident that the platform offers affordable options for all travelers.

“We don’t know what the economy is going to bring, but we do know that Airbnb is resilient to almost any kind of economic shock,” Dave Stephenson, Airbnb’s chief financial officer, said on a conference call after the results. “We’re going to continue to grow. We’re growing headcount at high single-digit percentage rates, but that is going to be able to support us for the very longterm. We’re going to remain very focused and disciplined in our investments.”

Severe disruption in the airline industry may also weigh on future travel. United Airlines Holdings Inc. and Delta Air Lines Inc. are among carriers cutting back flights to deal with staff shortages, surging fuel costs and a flood of passengers cramming themselves onto planes now that COVID travel restrictions have eased.