Feb 28, 2021

Airline Stocks Are Soaring, But There’s Still a Long Way Back

, Bloomberg News

(Bloomberg) -- For all the optimism about travel restarting as vaccines are rolled out, airline stocks still have a way to go to make up the ground they lost in the pandemic. It may take signs of a recovery in long-haul flights for the sector to make further gains.

The Bloomberg World Airlines Index soared 15% this month but is 17% below its 2020 peak, set in January before the coronavirus outbreak hit the world with full force. Leisure travel looks set to rebound sharply in coming months, if bookings are any guide, though a revival of business trips and intercontinental flights seems a bit further off.

“Globally, countries still need to reopen their borders, as well as reopen tourist attractions and the like before people travel internationally,” said Helane Becker, an analyst at Cowen Inc. in New York. “Airlines need for things to reopen and for borders to reopen and the revenue issue will resolve itself.”

Among European airlines the big winners have been Ryanair Holdings Plc, the Irish low-cost carrier, and Wizz Air Holdings Plc, the Eastern European company that’s modeled itself after Ryanair. They’ve benefited from a focus on vacationers rather than business clients.

British Airways parent IAG SA on Friday posted its first annual loss in almost 10 years, but said there’s reason for optimism about this summer.

Still, work-related travel may be slower to return given that many businesses have grown more comfortable with remote working and video conferencing.

“As travel restrictions in the U.K. and elsewhere ease, we believe demand will recover quickest at Ryanair, Wizz Air and other low-cost carriers,” Rob Barnett and Conroy Gaynor of Bloomberg Intelligence wrote in a report last week. “A slower pace is likely at full-service airlines such as IAG, as the rebound in long-haul travel may not be as quick.”

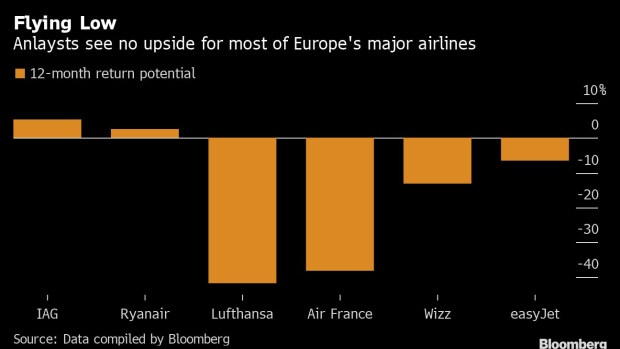

Analysts are skeptical about the recovery. Among major European airlines, brokerages see only two providing investors with a positive share-price performance over the next year. For Deutsche Lufthansa AG and Air France-KLM, the average analyst price target implies declines of more than 40%.

In Asia, where the pandemic hit first early last year, a Bloomberg Intelligence index of Asian carriers has surged 5.4% this week, beating the region’s benchmark by the most in more than a decade. The index recouped all the losses from last month, when a resurgence of infections in Asia rattled travel-related stocks. The sector is at the highest since January 2020, when Covid-19 started to force passengers to cancel trips.

“I think the vaccine news has been priced in,” said Luya You, an analyst at Bocom International in Hong Kong. “For airline stocks to rise further, we really need to see what the vaccine take-up is like later this year.”

If the vaccine is widely accepted, she said, the next thing to watch is whether Asia countries use so-called vaccine passports -- certificates to exempt travelers from quarantines or have shorter quarantine time. “This will be a huge catalyst for the sector,” she said.

You has buy ratings on companies in China, where the coronavirus largely has been contained, including China Southern Airlines Co., Air China Ltd. and China Eastern Airlines Corp. The carriers have the potential to grab global market share once international travel resumes, You said.

In the U.S., airline shares have soared since August amid the growing optimism about coronavirus vaccines. The biggest gainers include Hawaiian Holdings Inc., Alaska Air Group In., SkyWest Inc., JetBlue Airways Corp. and Delta Air Lines Inc.

Stronger balance sheets are also supporting the sector’s recovery. Shareholders subsidized the industry’s sudden cash needs through at least 17 stock offerings during the pandemic, according to data compiled by Bloomberg. Carriers that used their equity lifelines are now trading 87% above their offering prices, on average.

However, investor enthusiasm may be getting ahead of itself as Wall Street analysts strike a far more cautious note. While an S&P index of airline stocks is now only down about 14% since the beginning of 2020, the average 2021 earnings estimate for the carriers has stayed around the same level since May, after dropping precipitously in early March of last year.

©2021 Bloomberg L.P.