Mar 5, 2020

Airline Warnings Show Coronavirus’s Sudden Risk to U.S. Travel

, Bloomberg News

(Bloomberg) -- In just a few days, U.S. travel has begun to crumble.

That’s the message from a sudden rash of warnings from U.S. airlines. Southwest Airlines Co. said Thursday that first-quarter sales would take a hit of as much as $300 million after a swift drop in demand. That came less than 24 hours after United Airlines Holdings Inc. and JetBlue Airways Corp. said they would trim flights as they brace for a slowdown.

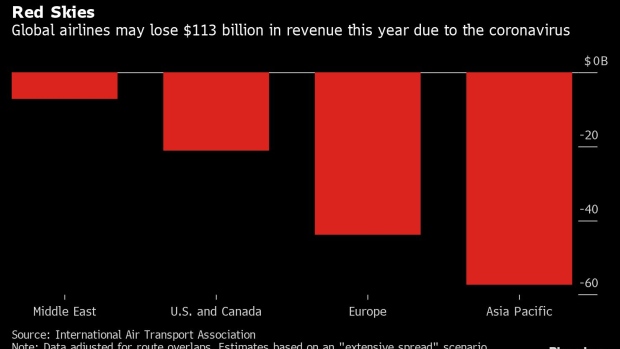

The tumble in demand underscored the escalating crisis for airlines as governments around the world try to contain the spread of an epidemic that has sickened more than 95,000. A global trade group for airlines said the industry will lose as much as $113 billion in sales because of the outbreak. As infections worsen in the U.S., companies from Boeing Co. to JPMorgan Chase & Co. have curtailed non-essential business travel.

“The spread of the coronavirus is rapidly sending the airline industry into a recession with the possibility of a global slowdown,” Andrew Didora, an analyst at Bank of America Corp., sad in a note to clients as he cut American Airlines Group Inc. to sell from hold.

American sank 9.5% to $16.77 at 11:03 a.m. in New York, the biggest slide on a Standard & Poor’s index of major U.S. carriers slid. Southwest slipped 4.6% to $44.78.

The benchmark has lost a quarter of its value since Feb. 21 as coronavirus fears intensified, the second-worst decline for an industry on the S&P 500 Index.

‘Unknown Proportions’

“The stocks right now are caught between a spreading virus of unknown duration and the potential of an economic slowdown of unknown proportions,” David Vernon, an analyst at Sanford C. Bernstein, wrote in a note to investors. He slashed price targets for the four biggest carriers.

Southwest said most of its first-quarter revenue blow will come this month, following healthy booking and revenue trends in January and February.

“In recent days, the company has experienced a significant decline in customer demand,” the Dallas-based carrier said in a regulatory filing.

Southwest’s warning on the sudden shift echoed comments by United Chief Executive Officer Oscar Munoz and President Scott Kirby on Wednesday.

“A lot has changed since this weekend,” the executives told employees in a memo that outlined reductions in domestic and international flights, as well as a hiring freeze and other cost cuts. “We certainly hope that these latest measures are enough, but the dynamic nature of this outbreak requires us to be nimble and flexible moving forward.”

Globally, the outbreak will cost the airline industry $63 billion to $113 billion in lost passenger revenue this year, the International Air Transport Association said, revising an estimate for a $30 billion loss made just two weeks ago.

That would represent a 19% sales drop from 2019 and a financial impact equivalent to what the aviation industry experienced during the global financial crisis over a decade ago, IATA said.

With higher infection totals reported each day, people are getting more anxious about being confined in small places such as jetliners.

Until last week, the U.S. had been relatively spared, but the situation changed rapidly over the weekend with more cases detected in states from Washington to New York. California declared a state of emergency late Wednesday to address the spread of the disease.

Pricing Drag

In another reflection of lower demand, Southwest said revenue for each seat flown a mile, a benchmark gauge of pricing power, could drop as much a 2% this quarter from a year earlier. The carrier previously forecast an increase of at least 3.5%.

One bright spot for airline finances is that oil prices have dropped as the virus outbreak slows economies worldwide. Southwest said it expects that a decline in fuel expenses will offset some of the negative impact from the virus. The airline estimated that its anticipated 2020 fuel expense has dropped almost $1 billion since the start of this year.

But lower fuel costs would be cold comfort if customers shun flying.

At United, the cut in U.S. flights will come largely from frequency reductions on most routes but the carrier will also suspend some service to cities that it serves from multiple hubs. The airline is also changing aircraft sizes on certain routes to adjust for the schedule reductions.

Last month, United withdrew its 2020 profit forecast, citing the financial impact of the virus outbreak and the resulting uncertainty. The company also postponed its March 5 investor meetings because of the issue.

JetBlue, which focuses primarily on the domestic market, will cut capacity 5% in the near term and watch booking trends to assess whether additional reductions are needed, Chief Operating Officer Joanna Geraghty said in a message to employees Wednesday.

‘Tough Decisions’

“We will make some tough decisions in the days ahead as we monitor the impact of coronavirus,” she said.

In Europe, where some airlines were already struggling before the outbreak, British carrier Flybe became the first high-profile industry casualty on Thursday.

Flybe, Britain’s biggest domestic airline, said it was going into administration partly as a result of pressure from the virus. Its collapse and a dire revenue outlook from the industry’s leading trade group stoked concern that the impact of the coronavirus could trigger the collapse of weaker carriers around the world.

--With assistance from Joshua Fineman.

To contact the reporters on this story: Cécile Daurat in Wilmington at cdaurat@bloomberg.net;Justin Bachman in Dallas at jbachman2@bloomberg.net

To contact the editors responsible for this story: Crayton Harrison at tharrison5@bloomberg.net, Brendan Case, Tony Robinson

©2020 Bloomberg L.P.