Apr 11, 2019

Airlines are today's biggest equity winners from Brexit delay

, BNN Bloomberg

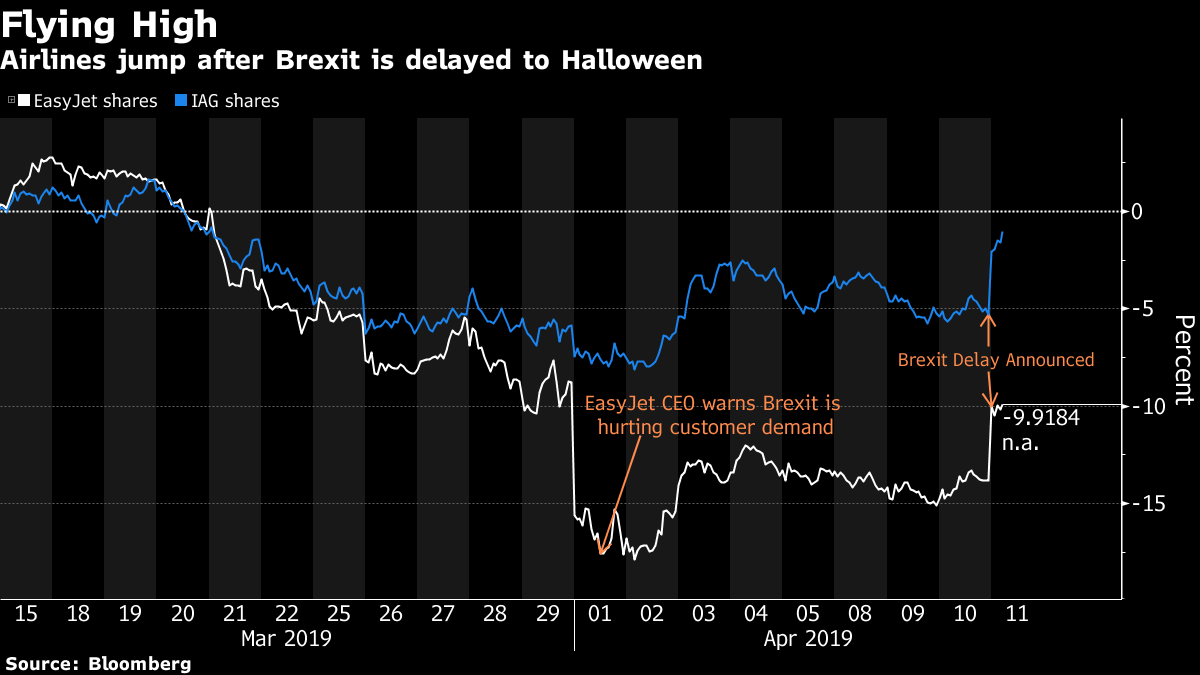

Brexit has been delayed. Again. And for stock-market investors, the clear winners are airlines and travel companies, which may benefit as Brits can now book their summer holidays to Europe.

EasyJet Plc and British Airways-owner International Consolidated Airlines Group SA both rose at least 4 per cent on Thursday, while Europe’s biggest holiday company TUI AG gained as much as 3.5 per cent. The Stoxx 600 Travel & Leisure sector rose 1.2 per cent and was the best performing sector on Europe’s benchmark.

A blueprint hashed out in Brussels on Wednesday night would allow the U.K. to stay in the European Union until October 31. EasyJet had said earlier this month that a British parliamentary stalemate over Brexit was “clearly” hurting customer demand.

“U.K. and European holidaymakers can now book their holidays without fear of a Brexit dislocation in the next six months,” Michael Hewson, chief market analyst at CMC Markets UK, said by email. Still, he referred to it as “mixed blessing” as “other businesses still have no clearer outline of what trading conditions will look like post Brexit, which means more delayed investment decisions, and more stagnation. Maybe we should all go on holiday and come back in six months’ time?”