Sep 28, 2022

Akbank Offers Highest-Ever Loan Pricing After Turkey Rating Cuts

, Bloomberg News

(Bloomberg) -- Sign up for our Middle East newsletter and follow us @middleeast for news on the region.

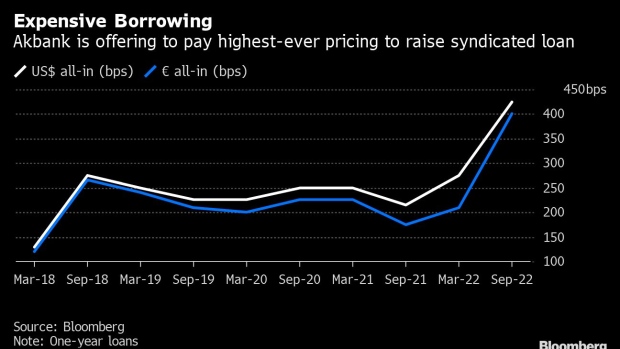

Akbank T.A.S is offering lenders improved returns on its upcoming October dual-currency loan, making it the most expensive loan ever for the Turkish lender, after global borrowing costs rose and major rating firms cut the sovereign’s credit grade.

The bank is expected to refinance a roughly $660 million syndicated loan due in early October. Akbank typically leads Turkish banks’ annual refinancing efforts, setting benchmark pricing that others follow.

The bank is expected to pay all-in costs of 425 basis points over Secured Overnight Financing Rate, or Sofr, and 400 basis points over Euribor, according to people familiar with the matter who aren’t authorized to speak publicly and asked not to be identified.

That implies a big jump from Libor+215 basis points and Euribor+175 basis points that the bank paid for borrowing $460 million and €206.8 million a year ago. Costs are also higher than the lender’s syndicated loan facility in April, when it paid Sofr+275 basis points for a dollar tranche and Euribor+210 basis points for a euro tranche.

“The cut in Turkey’s sovereign credit ratings and following rise in CDS rates have an impact in rising costs,” Akbank said in an emailed statement to Bloomberg.

The new loan will be tied to similar sustainability targets as previous facilities including energy sourced from renewable sources and renewing expiring credit cards with recycled ones. The bank’s existing loan is currently being offered at 500-700 basis points in the secondary market.

Akbank’s $660m ESG-Linked Loan Attracts More Than 30 Lenders

The higher cost of borrowing comes as credit rating firms Fitch Ratings and Moody’s Investors Service cut the country’s sovereign ratings further into junk in the last 12 months as ultra loose monetary policy contributes to spiraling inflation and depreciation of the currency.

Lira has tumbled 28% against the dollar this year, making it the second worst performing currency after Argentinian peso among emerging market peers. President Recep Tayyip Erdogan’s insistence on low interest rates despite runaway inflation has been weighing on the country’s risk premium ahead of next year’s elections, with Turkey’s five year credit default swaps hovering over 800 basis points.

Risks may also hamper rollover ratios in borrowings.

“We may see some banks that have a short-term or opportunistic approach to Turkish markets not taking part in the new facility,” Akbank said. “However, we expect banks that we have major relations with to continue participating in our syndications.”

©2022 Bloomberg L.P.