Oct 17, 2018

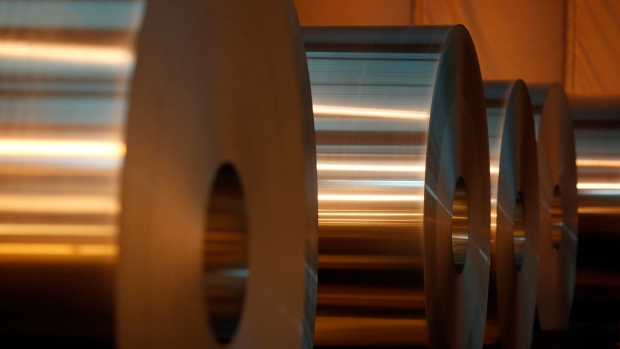

Alcoa surges on profit surprise, first buyback since split

, Bloomberg News

Alcoa Corp. reported third-quarter earnings that were double estimates and announced its first share buyback in more than a decade in a sign that the top U.S. aluminum producer is weathering the trade war.

Shares jumped 4.6 per cent after regular trading in New York as the company said it would buy US$200 million of its stock, the first repurchase since 2007, when the manufacturer was a still combined commodity and metal-parts producer, according to data compiled by Bloomberg. Alcoa split from its auto- and jet-components business in late 2016.

“By reducing complexity, driving returns, and strengthening the balance sheet, we’ve made Alcoa a much stronger company even as commodity markets remain volatile,” Chief Executive Officer Roy Harvey said in a statement Wednesday.

The company earned 63 cents a share after adjusting for one-time items, topping the 30-cent average of analysts’ estimates compiled by Bloomberg.

The buyback comes even as Pittsburgh-based Alcoa trimmed its demand forecast for the global aluminum market, a reduction the company said was driven by China.

“We continue to see that the world is a pretty uncertain place,” Harvey said in an interview following the earnings release.