May 25, 2023

Aldi Cuts Prices Further, Boosting Competition With Grocery Stores Like Walmart and Kroger

, Bloomberg News

(Bloomberg) -- Aldi’s US unit has a message for rival grocers as inflation finally starts to slow: Price wars are coming back.

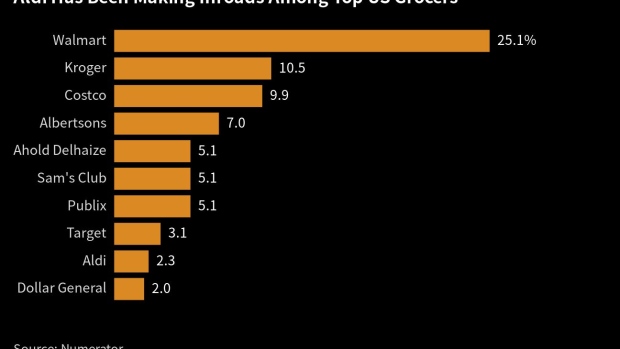

The German-owned discounter cut prices this week on 250 items, including protein bars, cheese and chicken tenders, according to a company statement Thursday. Aldi has expanded in the US in recent years, creating sharp competition with market leaders such as Walmart Inc., Kroger Co. and Albertsons Cos.

“We have been waiting for this moment for a couple of years,” Dave Rinaldo, co-president at Aldi US, said in an interview. The company has harbored an “emphatic belief” that it “needs to move “as quickly as we possibly could” as soon as cost increases slow or plateau, he added.

The move by Aldi, a low-cost market leader, signals a sharper focus on prices as grocers rein in expenses and push back on higher bills from suppliers. Elevated inflation levels have eroded consumer purchasing power, potentially giving a significant edge to retailers that can undercut competitors. At the same time, price cuts may complicate rivals’ attempts to restore margins that have slumped in recent quarters.

Aldi estimates its price cuts will provide consumers with $60 million in savings this summer. It’s making the move as more retailers warn that shoppers are under increasing financial pressure.

Dollar Tree Inc. said Thursday that its customers, who are mostly toward the lower end of the income spectrum, are increasingly “prioritizing needs over wants.” Walmart said last week that it’s working with vendors of prepared foods and consumable goods to bring down costs and lure in shoppers.

“Fresh food inflation has meaningfully come down in recent months, but inflation in dry grocery products (e.g., cereal, spices, snacks) has remained elevated,” CFRA analyst Arun Sundaram said in a report. “Walmart has recently voiced its concern over persistent inflation in dry grocery and consumable categories, which we believe is a warning shot for consumer packaged goods companies looking to further raise prices.”

Read More: Walmart Throws Its Weight Around to Fight Inflation: Conor Sen

Overall grocery prices in the US declined in both March and April, a welcome respite after more than two years of price increases. That said, food costs remain well above pre-pandemic levels, particularly in categories such as eggs and bakery products, which are both up by double-digits from a year ago.

Indeed, Rinaldo said Aldi is struggling to contain costs in areas such as baked goods and breakfast items. By contrast, the company has seen pressures ebb in fresh meat and produce.

Product costs aren’t the only driver of the new round of price cuts, or even the primary one. Transportation expenses have eased, giving Aldi some leeway to pass on savings to shoppers, Rinaldo said. The company also expects additional savings from other efficiency gains as the year goes on.

Aldi has been grabbing market share as it expands in the US. The company plans to add 120 stores this year, giving it more than 2,400 locations by year-end — almost as many as Kroger, and more than Albertsons.

“Now that we’re at the point where we can pass these price savings along, our goal is to come forward with more,” Rinaldo said, adding that it’s “the beginning of really continuing to invest in dropping prices.”

--With assistance from Olivia Rockeman.

©2023 Bloomberg L.P.