Mar 27, 2023

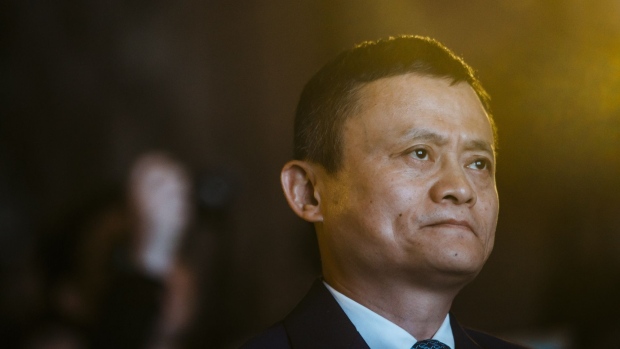

Alibaba Jumps After SCMP Reports Jack Ma Returned to China

, Bloomberg News

(Bloomberg) -- Alibaba Group Holding Ltd. surged as much as 5.5% before relinquishing all gains in Hong Kong, after news emerged that billionaire co-founder Jack Ma had returned to his home country after more than a year abroad.

The co-founder of Alibaba and fintech affiliate Ant Group Co. visited a school he founded in his hometown of Hangzhou, according to an official WeChat post by the institution. Ma met with teachers and students at a private school he helped establish in 2017, discussing issues from education to ChatGPT AI technology, the South China Morning Post reported earlier. Alibaba’s shares ended Monday largely unchanged.

Ma, one of China’s most recognizable business leaders, all but disappeared from public life after critiquing Chinese regulators in a 2020 public speech in Shanghai.

Read more: Jack Ma’s Self-Exile Undercuts China’s Pitch to Private Business

In the years since, the government has cracked down on sectors from real estate to the internet and online education. While Beijing has said it would support the private sector to revive the economy, the global business community remains skeptical of the Chinese government’s commitment to enterprise that isn’t state-owned.

But as President Xi Jinping consolidates power and refocuses his attention on the economy, the country’s new leadership team wants to develop a business-friendly image.

Chinese authorities made attempts to persuade Ma — who has been traveling outside the mainland — to return and help showcase government support for the business community, Bloomberg News reported. But Ma had chosen to stay overseas, saying he has retreated from his companies to focus on researching agriculture technology, according to people familiar with the situation, who asked not to be named because the matter is private.

“Jack Ma showing up in Hangzhou after more than a year away from China should be positive for market sentiment,” said Vey-Sern Ling, managing director at Union Bancaire Privee. “Some investors may take it as a sign of further regulatory normalization for the tech companies.”

--With assistance from Lulu Yilun Chen and Lin Zhu.

(Updates with share action from the first paragraph)

©2023 Bloomberg L.P.