May 28, 2019

Alibaba's US$20B share sale to pressure Hong Kong rates

, Bloomberg News

A planned US$20 billion offering by Alibaba Group Holding Ltd. (BABA.N) would likely squeeze liquidity in Hong Kong, pushing up borrowing rates in the city and strengthening the local dollar.

China’s largest company is considering a second listing in Hong Kong, people familiar with the matter said, potentially rivaling AIA Group Ltd.’s initial public offering in 2010 as the city’s biggest-ever share sale. Liquidity would tighten in the weeks around a listing due to demand for cash from subscribers. Alibaba raised a record US$25 billion in its 2014 debut in New York.

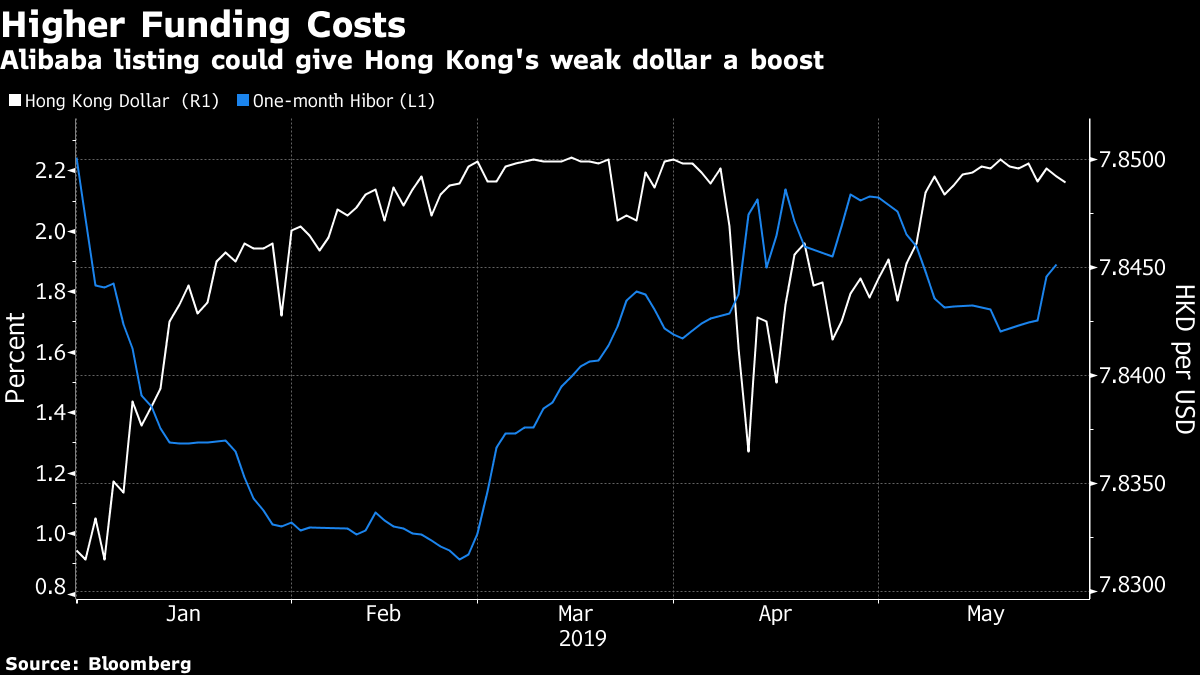

“If it does raise such a huge amount of money in the Hong Kong stock market, then I think the Hibor, especially the front-end liquidity, would tighten around this period,” OCBC Wing Hang Bank Ltd. economist Carie Li said, using the term for interbank rates in the city. “It could push up the Hong Kong dollar by quite a significant magnitude, although it won’t last.”

A rise in Hibor affects the cost of everything from mortgages to corporate loans, and can linger after big share sales. Hong Kong borrowing costs climbed in the lead up to smartphone-maker Xiaomi Corp.’s IPO last year, with the one-month interbank rate hitting its highest since October 2008. Short-term rates then tumbled amid tepid demand.

Alibaba aims to file a listing application in Hong Kong as soon as the second half of 2019, the people familiar with the matter said.

A spike in borrowing costs could bring some welcome relief to the Hong Kong dollar. The currency has butted against the weak end of its 7.75-7.85 trading band versus the greenback several times this year, forcing the local monetary authority to intervene to defend the currency peg. The Hong Kong dollar was up 0.01 per cent at 7.8487 per greenback at 11:16 a.m. local time Tuesday.