May 26, 2022

Alibaba Sales Beat as Consumption Holds Up During Lockdowns

, Bloomberg News

(Bloomberg) -- Alibaba Group Holding Ltd. reported a better-than-expected 9% rise in revenue after Chinese consumers turned to online malls for basic needs during Covid lockdowns across the country.

Its shares rose 4% in pre-market trading in New York. Revenue increased to 204.05 billion yuan ($30.3 billion) in the March quarter. While that marked the second straight quarter of single-digit growth, sales topped the 200.6 billion yuan analysts expected. The company refrained from offering a projection for annual revenue, citing uncertainty arising from Covid curbs.

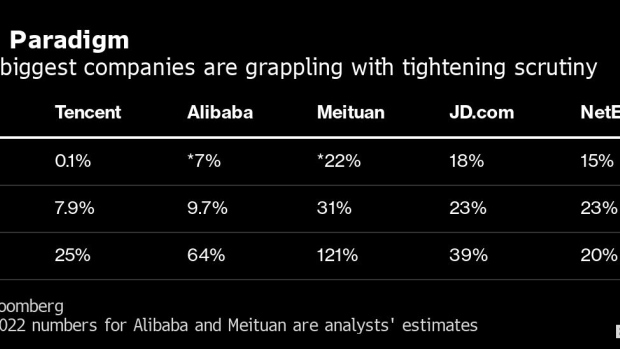

Alibaba -- a barometer for Chinese consumer sentiment because of its dominance of Asia’s largest retail arena -- is grappling with intensifying competition and mounting economic uncertainty at home. Chinese retail sales have slid for two straight quarters as stringent Covid-19 lockdowns tangle supply chains and dampen spending from Beijing to Shanghai.

Chinese antitrust watchdogs have also chilled Alibaba’s expansion plans and helped JD.com Inc. overtake it on sales growth, while up-and-coming competitors from ByteDance Ltd. to Pinduoduo Inc. are drawing users from the traditional online-shopping leaders.

Like rival Tencent Holdings Ltd., Alibaba is responding to a new era of sharply lower growth brought on by relentless Beijing scrutiny. The e-commerce giant said in February it’ll focus on retaining users rather than pursuing the aggressive market-share grab of years past. That marks a major shift for a company that once fought rivals in arenas from media to the cloud and retailing, and follows more than a year of relentless curbs on every facet of China’s internet sector. Its net loss widened in the quarter to about 16.2 billion yuan, after the value of its investments fell. Alibaba’s annual active users in China surpassed the 1 billion mark.

Click here for a live blog on the results.

What Bloomberg Intelligence Says

“Due to weaker retail sales and logistics disruptions caused by Covid flare-ups in mainland China, the internet giant will likely further increase support to merchants in the form of lower marketing and transaction fees payable by them on the company’s platforms such as Taobao, Tmall and Ele.me.”

- Catherine Lim and Tiffany Tam, analysts

Click here for the research.

Once the most valuable company in China, Alibaba has seen its market value erode since Beijing launched its sweeping crackdown on the private sector more than a year ago. The government forced Alibaba’s finance affiliate, Ant Group Co., to call off what would have been the world’s largest initial public offering in 2020, and then launched reforms that have undercut Alibaba’s business model.

The market has been lukewarm on the government’s repeated pledges to support the internet sector and boost the lagging Chinese economy. Last week, Tencent said it will take time for regulators to take action.

More recently, China’s commitment to Covid Zero has hit the world’s second-largest economy, with production and logistics suffering from stringent anti-virus measures. Companies are quarantining thousands of workers and having them sleep on factory floors, with operations being disrupted by repeated mass testings and movement restrictions. In a rare show of frustration, Tencent’s billionaire co-founder Pony Ma shared a viral opinion piece on the economic costs of China’s strict Covid Zero measures this week.

In a response to domestic hurdles, Alibaba has turned increasingly outward -- Lazada, its Southeast Asian arm, Trendyol in Turkey and Daraz around South Asia have evolved into important units of the company. Alibaba has outlined a long-term goal of quintupling Lazada’s gross merchandise value, the sum of transactions across its platforms, to $100 billion.

(Updates with share action starting in second paragraph)

©2022 Bloomberg L.P.