Jun 9, 2022

Alibaba Shares Jump as China Considers Reviving Ant Group IPO

, Bloomberg News

(Bloomberg) -- Alibaba Group Holding Ltd.’s US-listed shares jumped after a Bloomberg News report that authorities may allow Ant Group Co. to revive its initial public offering, bolstering conviction that the days of a tech crackdown are nearing an end.

Alibaba, which owns a thrid of Ant, gained as much as 7% in premarket trading, reversing a decline of more than 5%. Other large-cap Chinese internet stocks also pared losses on the news. The KraneShares CSI China Internet Fund, an exchange-traded fund that tracks Chinese tech stocks, rose 1% after a three-day surge of 15%.

The China Securities Regulatory Commission has established a team to reassess the fintech giant’s share sale plans, according to the report. Authorities are also nearing the final stages of issuing Ant a long-awaited license that would clear the path for an IPO and make the company regulated more like a bank.

The sudden scuttling of Ant’s IPO in November 2020 -- just days before the fintech juggernaut was to go public -- marked the beginning of China’s hallmark regulatory squeeze that has swept across the country’s internet sector. The crackdown has seen foreign investors flee as investing in China’s big tech companies became fraught with regulatory risks.

Increasing signs point to Beijing’s more lenient stance following officials’ repeated pledges to prop up the bruised sector. The Wall Street Journal reported this week that regulators are preparing to wrap up their investigation into Didi Global Inc. On Tuesday, China approved its second batch of games this year, an acceleration from the 45 in the first batch.

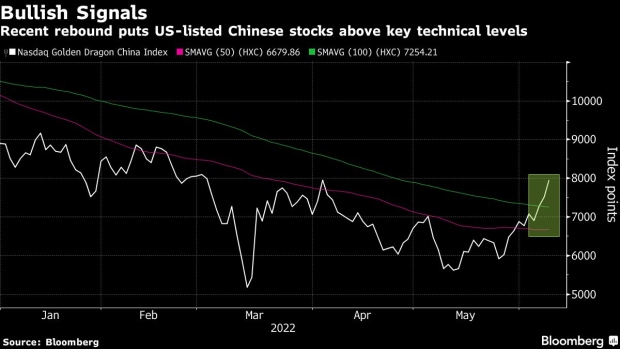

Having spent most of the past year under pressure, Chinese tech shares have outperformed US peers in recent sessions, with sentiment helped by the easing in Covid lockdown measures at major cities and a string of better-than-expected earnings. The Nasdaq Golden Dragon Index is down 11% this year, compared with the Nasdaq 100’s 23% slump.

©2022 Bloomberg L.P.