May 21, 2018

All Roads, Electric or Oil, Lead to China

, Bloomberg News

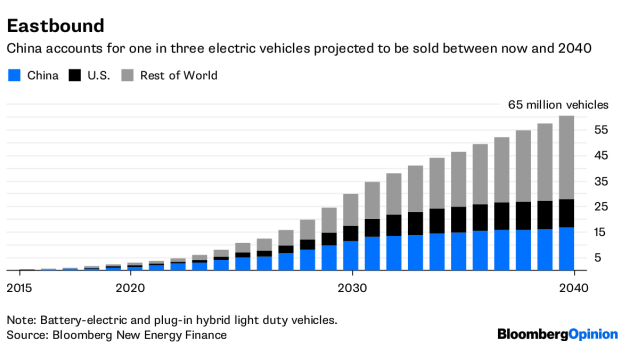

(Bloomberg Opinion) -- A decade ago, knowing where the oil market was going meant knowing China. Today, the same can be said for electric vehicles — which means it still applies to oil, too.

That’s a big takeaway from the latest edition of Bloomberg New Energy Finance’s annual Electric Vehicle Outlook, published on Monday. China isn’t the whole ballgame, but its role in determining the feasibility and pace of a revolution in road transportation is inescapable. Sheer size is one reason for that:

There’s more to it than just bigness. Speed counts, too. Almost 72,000 passenger electric vehicles, or EVs, were sold in China in April, up 136 percent from a year earlier, and almost four times as many as were sold in the U.S.

When BNEF released its outlook last year, I made the point that a key moment to look for was not when EV sales overtake traditional vehicles, but when EV growth begins to account for all growth in the entire market. At that point, sales of regular vehicles with internal combustion engines (ICE) will still dwarf those of the upstarts, but will have begun to decline — with big implications for investment in and further adoption of EVs. In last year’s projection, that moment occurs in 2026; in the latest forecast, 2023. That’s mostly due to China.

China’s EV market is supported by the country’s New Energy Vehicle subsidy program, which was tweaked recently to favor longer-range and more efficient models. China has good reasons to promote EV development at home, including cutting local pollution and mitigating dependence on imported oil.

Also important is the opportunity for the country to seize leadership in a new industrial field, rather than just play catch-up in old ones. As I argued here, manufactured energy plays far more to China’s strengths than the extracted kind championed by its “energy dominance”-favoring rival across the Pacific.

One of the striking aspects of China’s market already is the level of competition within it. There are almost 30 companies selling EVs in China, either alone or via joint ventures — almost double the number in the U.S., according to data compiled by BNEF. While Tesla Inc. took 26 percent of the battery EV market in the U.S. last year, it accounted for less than 4 percent of China’s. The Herfindahl-Hirschman Index of market concentration demonstrates just how quickly competition has mushroomed in China:

The entire case for optimism on EVs rests on the continued decline in their cost, especially for batteries. So the rapid emergence of competition in the biggest growth market for these new vehicles is perhaps the single most important factor working in favor of EVs worldwide (see, for example, what China did for solar panels).

The flip side of this is what it means for oil. Here, again, China’s role goes beyond its mere size.

In a special supplement to this year’s EV report, BNEF also projects what the adoption of EVs, electric buses and autonomous vehicles means for road-fuel consumption. Overall, these technologies remove 7.3 million barrels a day of demand by 2040, according to BNEF’s forecasts.

Beneath the headline figure, however, it’s worth looking at the projections for the U.S., the world’s largest oil market, and China, the world’s largest EV market:

The striking thing in that projection is that while EVs compound the expected decline in U.S. road-fuel demand, in China they turn a growth market into a profile of flat to declining consumption. Growth in Chinese demand for oil is no longer as dominant a factor as it was a decade ago, but it’s still projected to account for more than a third of global growth through 2040. If BNEF’s updated projections prove directionally right, EVs would put a significant crack in those expectations. This is the ball game.

To contact the author of this story: Liam Denning at ldenning1@bloomberg.net

To contact the editor responsible for this story: Mark Gongloff at mgongloff1@bloomberg.net

The HHI is used by competition regulators in assessing the impact of mergers. The higher the score, the more concentrated the market.To calculate HHI scores, you first multiply the percentage market shares of participants by 100 to convert them to whole numbers. Then you raise those to the power of 2 and add up the resulting numbers. So, for example, a market with 10 companies each holding a 10 percent sharewould have an HHI score of 1000 ((10^2) x 10 = 1000). A market with 10 companies where one held 50 percent and the others all 5.6 percent would score 2778The U.S. Department of Justice generally regards a market scoring 1500 to 2500 as moderately concentrated, while anything above 2500 is highly concentrated.

©2018 Bloomberg L.P.