Oct 31, 2019

All the stuff bugging the stock market that isn't impeachment

, Bloomberg News

Surprise, Donald Trump says his enemies are killing the stock market. A quick perusal of the S&P 500’s swings this morning shows investors have more on their minds than the impeachment hearings.

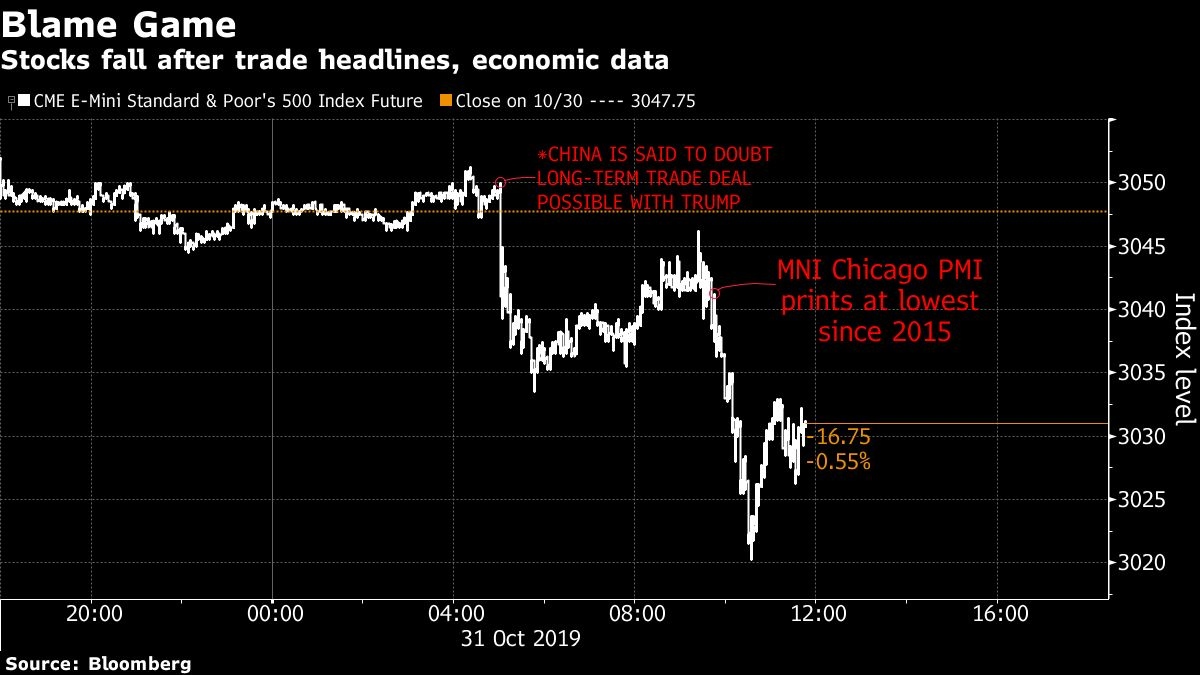

As can be seen in the chart below, index futures suffered almost all their losses in two distinct swoons today, one starting around 5 a.m., the other after markets opened. And those drops followed two clear helpings of bad news: first, a Bloomberg News story that Chinese officials are casting doubt about a comprehensive trade deal, the second around 9:45 a.m. when the Chicago PMI printed weaker than expected.

“It has to be some of the comments out of China regarding the trade negotiations,” said Peter Jankovskis, Oakbrook Investments LLC’s co-chief investment officer. “And then on top of it you do have some of the economic data just reinforcing that trade continues to be a big drag and we still don’t have visibility of what the resolution will be.”

While the president tied Thursday’s stock market swoon to the ongoing impeachment inquiry, which is looking into his dealings with Ukraine, equities actually bounced as the House began voting on the procedures. The S&P 500 was down 0.4 per cent as of 11:42 a.m. in New York, while the Dow Jones fell 0.6 per cent.

Thursday’s tweet wasn’t the first time the president blamed the impeachment inquiry for market declines. He mentioned it Oct. 2, when the S&P 500 was in the throes of its biggest two-day drop in a month — a selloff sparked by weak readings on manufacturing and hiring. The index subsequently rallied 5.5 per cent through Wednesday.

Investors have also had time to digest the goings-on in Washington. Speaker Nancy Pelosi had announced on Monday that the House would vote to support the ongoing impeachment inquiry and the stock market subsequently reached record levels during two separate sessions this week.

A fair amount of disappointing economic reports have hit since the Federal Reserve’s signal on Wednesday that its rate cut was the last for a while. Data showed the U.S. consumer — the linchpin of the American economy — trailed forecasts, while applications for unemployment benefits rose more than projected.

As for tariff negotiations, a so-called “phase one” trade deal between the U.S. and China has already been cast into doubt after Chile cancelled an upcoming summit where Trump and Xi Jinping had planned to meet, though Trump tweeted the two sides are seeking a new location.

“The notion that there will be a phase two and phase three is equal parts naive and hopeful,” Mark Stoeckle, chief executive officer and portfolio manager of the Adams Funds, said in an interview at Bloomberg’s New York headquarters. “They think they can wait out Donald Trump, that if he isn’t elected that somebody else will be easier to deal with. But I think the new reality is we’ll be at a trade war with China for a very, very long time.”

While this morning’s declines seem explainable by things other than domestic politics, would the market be OK if odds of impeachment rose significantly? Entirely different question. But unless that happens, investors said, the economy and the Fed are likely to keep calling the tune.

“Until we get to that point they feel confident enough that they actually have the votes to truly move forward to impeachment, I think the market is going to continue to see this as a background issue,” Jankovskis said.