Sep 15, 2020

All the Ways Day Traders, Nasdaq Whales Move Stocks Via Options

, Bloomberg News

(Bloomberg) -- Beyond all the wrangling over who caused the recent boom in options is a more fundamental debate: How much do they matter to stock prices, anyway?

Quite a bit, according to the academic research.

Conclusions have varied over the years, but the weight of evidence points to three main channels through which options can drive equity prices -- all of which may have been at play of late.

Wall Street has been looking for culprits in an explosion in volatility, with September posting three of the worst days for technology stocks in 2020.

The first channel is informational, where derivatives activity -- until recently assumed to be conducted by more informed traders -- influences investor behavior elsewhere. The second is more direct, and sees options dealers buy and sell stocks to hedge their positions. And the third is a specific price impact on the day options expire.

What follows is a look at recent trends in the options space, and how they fit in with key research connecting derivatives to moves in their underlying stocks.

Signaling

Of all the twists in the saga of the U.S. stock market this quarter, one of the biggest was SoftBank Group Corp.’s purchase of billions of dollars worth of options on tech shares.

The Japanese investment giant bought and sold calls -- contracts giving the right to buy a stock at a preset price -- for a few megacap names. The idea was to profit if equities rose, but a side effect may have been to help make sure they did.

In a paper published at the start of the year, academics from the University of Miami, the Singapore Institute of Technology and the Singapore Management University argued options contracts play an important role for price discovery on the underlying stock.

Options volume show informed investors at work, and provide a valuable signal about a share’s likely future performance, according to Gennaro Bernile, Fei Gao and Jianfeng Hu.

They used two decades of data to show options activity both predicts returns and “anticipates the flow of fundamental information about a stock.”

That suggests by taking such large positions in the options market on single stocks -- as opposed to a broad index -- it’s possible SoftBank persuaded other market watchers it knew more than they did.

According to Benn Eifert, chief investment officer of hedge fund QVR Advisors, the size of the trades would have likely inspired “copy catting” and caused others to try to front-run them.

Based on Bernile, Gao and Hu’s research, this likely would have also led to buying pressure for stocks.

Hedging

An explosion of activity in options on single stocks -- often in contracts with near-term expirations and low prices and executed in small batches -- has persuaded market participants that tens of billions of dollars of mom-and-pop cash is now at play.

Many believe this helped fuel one of the biggest rallies in tech shares since the dot-com bubble.

Read more: Bored Day Traders Locked at Home Are Now Obsessed With Options

Almost by definition, a vast group of tiny trades is unlikely to signal participants operating with an informational advantage. But that doesn’t mean they didn’t contribute to the tech surge.

In a key 2007 paper, researchers at the University of Illinois at Urbana-Champaign showed that hedging activity by market makers in the options space affects stock return volatility and the probability of large moves.

In other words, the firms acting as dealers in the options market take on risk with every transaction, and to adjust their protection they buy or sell shares of the underlying stock.

If they have a big enough exposure -- say, if billions of dollars of new retail cash mean booming demand for call options -- they potentially need to buy a lot of equities to hedge what is known as their “short-gamma” position.

Authors Neil Pearson, Allen Poteshman and Joshua White called their paper “the first evidence for a substantial and pervasive influence of option trading on stock prices.” The results at the time were startling. The team estimated that about 12% of a stock’s daily absolute return was caused by options players rebalancing hedges.

As tech stocks rallied this year, there was evidence to support this theory. Implied volatility for the Nasdaq 100 Index was rising at the same time as the gauge itself, a rare event signaling unusual demand for both shares and their options.

“While there is debate on the size of the impact, the surge in near term call buying has had an impact on stock moves,” Chris Murphy, Susquehanna International Group’s co-head of derivatives strategy, wrote in a note. “Near term (within two weeks) options that are close to the money are typically hedged more actively, which may result in exacerbated market moves.”

Clustering

A boom in options means many more contracts are created, and that means more of them expiring at the same time. In 2004, Pearson and Poteshman collaborated with Sophie Xiaoyan Ni of the Hong Kong Baptist University to demonstrate that, on option expiry days, stock prices “cluster” at the strike prices of those options.

Their paper ascribed the cause to hedge rebalancing and price manipulation by option writers.

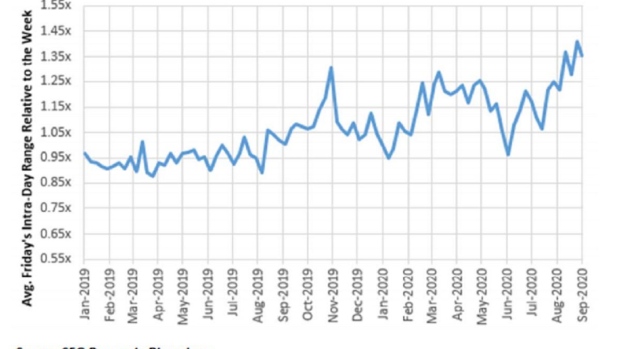

At Susquehanna, Murphy’s colleague Souhow Yao has recorded a steady increase in the Friday trading range of Apple Inc. That supports the idea that options expiration has resulted in more intraday volatility, he said.

“Given the increased popularity of trading weekly options, it’s conceivable that we could see trading moves exacerbated on Fridays due to dealers hedging expiring positions,” Murphy wrote.

©2020 Bloomberg L.P.