Jan 25, 2022

Allianz Doubles Down on Alternatives After Hedge Fund Blowup

, Bloomberg News

(Bloomberg) -- Allianz SE’s new head of asset management plans to push further into alternative asset classes and continue its focus on active fund management, even after the implosion of a hedge fund strategy in the U.S. left the German insurer mired in potentially expensive lawsuits.

Speaking in his first interview in the new role, Andreas Wimmer declined to comment on the legal issues. But in a sign that they haven’t dented the firm’s appetite for alternatives, he highlighted real estate, infrastructure and private debt as main areas of growth for the owner of Pacific Investment Management Co. and Allianz Global Investors.

“Flirting with passive strategies wouldn’t be the first thing I would do,” Wimmer said in a wide-ranging interview last week. “But you don’t have to categorically rule out anything for the future.”

Allianz, whose investment units oversee about 2.5 trillion euros ($2.9 trillion) for the group’s insurers and outside clients, has long shied away from joining the rush into passive strategies, where fees are low and scale is everything. While that’s served the firm well for the most part, it has also exposed it on rare occasions when active strategies failed to deliver or a star manager abandoned ship.

Wimmer took over responsibility for asset management in October after Jackie Hunt stepped down amid probes and investor lawsuits related to the firm’s Structured Alpha Funds, which suffered steep losses during the pandemic. Like Hunt, who helped steady the business after the departure of Pimco co-founder Bill Gross, he argues that active managers have an edge in alternatives.

Read more:

Allianz Asset Head Leaves Amid Multiple Probes, Lawsuits

Allianz Lifts Outlook to Reassure Investors After Fund Probe

Allianz Slumps as Insurer Warns on Impact of U.S. Fund Probe

Wimmer, who still oversees some insurance activities in addition to his new role, is credited for lowering guaranteed payouts of life insurance products in Germany, protecting Allianz’s margins from negative bond yields. Analysts at Jefferies in a note last year said he appears be a “safe pair of hands to guide the U.S. franchise through its current difficulties.”

In real estate, he wants to take more advantage of opportunistic investments than in the past. Merging Allianz Real Estate, a more traditional investor, into Pimco is helping Allianz to execute complex property transaction, Wimmer said.

“The acquisition of Columbia Property Trust is a great example”, he said. Pimco agreed to buy the landlord for $3.9 billion including debt in September, betting that demand for offices will hold up as the pandemic spurs people to work from home. Wimmer said Allianz will likely also target more investments in logistics properties and residential buildings.

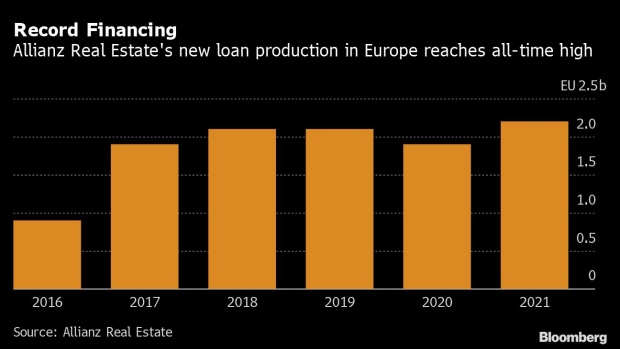

Another area where Wimmer wants to beef up investments is private debt. Last year, Allianz Real Estate alone granted 2.2 billion euros in new loans across Europe, a new record for the region and bringing the European debt portfolio of the unit to more than 11 billion euros.

“It’s about areas in which banks have withdrawn and asset managers play a larger role as financiers,” he said.

While Allianz is expanding some offerings, it has been cutting back others, especially at AGI, which housed the imploded U.S. hedge funds. Of the about 450 active investment strategies that existed at the end of 2019 at the unit, around 140 were discontinued or merged with other strategies in the last two years, Wimmer said.

The potential fallout from the implosion of the Structured Alpha Funds notwithstanding, Allianz remains one of the potential consolidators as the asset management industry is forced to reduce costs to compete with cheaper, passive funds. Wimmer said while his priority is to grow Allianz’s asset management business organically, he wouldn’t rule out a deal.

“There can also be inorganic growth,” he said. “But we are all aware of what we are currently seeing in the markets in terms of prices for asset managers. Allianz’s strategy has always been to look at things with a certain sense of proportion.”

(Adds details on real estate investments in 8th paragraph)

©2022 Bloomberg L.P.