Oct 26, 2021

Google's growth overshadowed by slower YouTube, cloud sales

, Bloomberg News

It's Still Hard to Be a Woman in Tech: YouTube CEO

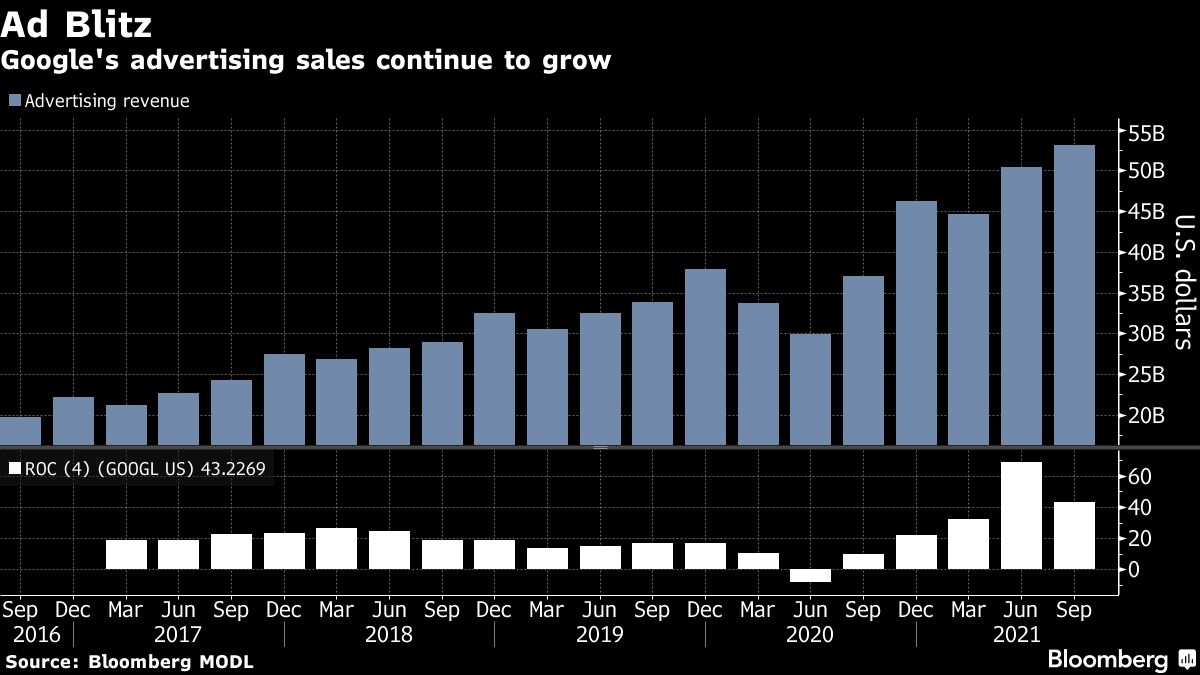

Google parent Alphabet Inc. reported quarterly sales that topped Wall Street estimates, reflecting robust advertiser spending, but disappointing results from its YouTube and cloud-computing divisions weighed on the stock.

Third-quarter revenue, excluding payments to distribution partners, was about US$53.6 billion, the company said Tuesday in a statement. Analysts projected US$52.6 billion, according to data compiled by Bloomberg. YouTube ad revenue and Google Cloud sales both fell short of analysts’ estimates, driving the shares down more than 1 per cent in extended trading.

Chief Executive Officer Sundar Pichai has tried to keep Alphabet’s revenue engine chugging along by prioritizing three areas: e-commerce, YouTube and cloud computing. That helped the internet giant rebound from a dour 2020, when some marketers pared their budgets as they coped with the initial shock of the Covid-19 pandemic.

Still, the company’s fortunes remain highly dependent on macroeconomic factors, including supply-chain doldrums that have plagued nearly every industry and could bite retailers and ad companies during the holiday-shopping season. The Mountain View, California-based company also has been let down by its video platform YouTube and its cloud arm, both of which are meant to help it diversify away from the core search engine that brings in most of its revenue.

The shares fell as low as US$2,700 in extended trading after closing at US$2,786.17. The stock has jumped 59 per cent this year.

Chief Financial Officer Ruth Porat said on a conference call that Apple Inc.’s anti-tracking app privacy features had a “modest impact on YouTube’s revenues” in the quarter.

Alphabet’s profit was US$27.99 a share in the third quarter, beating the average estimate of US$23.50. But YouTube ad revenue came in at just US$7.2 billion. Analysts were looking for the world’s most popular video-sharing site to generate about US$7.5 billion.

Sales from the company’s cloud division rose to US$4.99 billion, missing Wall Street expectations of US$5.04 billion. While the unit has gained some market share under Thomas Kurian, it still lags far behind leaders Amazon Web Services and Microsoft Corp.

“It was modestly off of the street’s estimate, but we feel very good with the momentum,” Porat said on a call with reporters. “We are very pleased with the ongoing progress across the board, the product innovation, the buildout of our teams and the strength across verticals.”

Alphabet also repurchased US$12.6 billion in shares last quarter, and said it had added nearly 18,000 full-time staff during the period, up to 150,028.

Search and other related businesses generated fiscal third-quarter sales of US$37.9 billion. Analysts, on average, estimated US$36.7 billion.

“They are benefiting still from some of the commerce moving online because of the pandemic,” Mark Ballard, a researcher at marketing performance firm Tinuiti, said in an interview ahead of the results.

Google recently launched its line of Pixel 6 smartphones, which it hopes will help the company break out in the competitive consumer-electronics market. But Porat said that like others, it’s also dealing with supply-chain issues.

“We’ve been risk-managing the supply-chain challenges well,” Porat said. “We are working closely with suppliers and logistics partners to plan and pivot when and where we need. With the strong reviews and demand on the Pixel 6, we do expect some supply constraints.”