Mar 10, 2023

Amateur Jockey Buys Failed Chinese Project in London’s Docks

, Bloomberg News

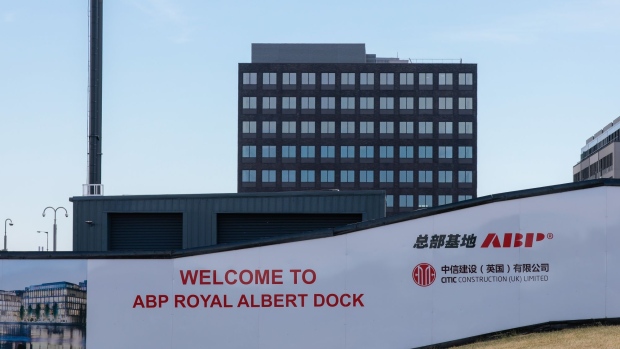

(Bloomberg) -- A British amateur jockey has bought part of an unfinished real estate project in London’s east end after Chinese plans to turn it into a vast business hub collapsed.

David Maxwell’s property firm DPK was selected as preferred bidder for the site in London’s Royal Albert Dock — previously owned by China’s ABP — earlier this year. It has now completed the acquisition out of bankruptcy, people with knowledge of the matter said.

Aside from being a property investor, Maxwell has also attracted attention in the UK by riding his own racehorses against professional jockeys. At one time, ABP had planned to turn the site, which has road names such as Mandarin Street, into a financial center to rival Canary Wharf and London’s Square Mile.

DPK bought the debt secured against an energy center at the site, CoStar News reported in December. That put it in pole position to acquire part of the 35-acre site and potentially the remainder of the project which is earmarked for 4.7 million square feet of development, the people said.

He Built It But No One Came: China Chills the Next Canary Wharf

Mark Addley, real estate restructuring leader at PwC, did not confirm the buyer’s identity but said he was pleased to secure a deal “especially given the challenging market conditions in the past months.” He said he hoped the sale would boost “this important, evolving London district.”

PwC said it would be paying a dividend to the creditors of the relevant companies within the next month.

DPK could not be reached for comment.

The project was once championed by Chinese President Xi Jinping and then UK Prime Minister David Cameron as Britain courted investment from the Asian super-power. However, relations have since cooled and ABP’s efforts to turn the district into a hub for Chinese business that would rival Canary Wharf proved fruitless. Xu Weiping, who led ABP, also blamed Brexit and delays to the city’s new Elizabeth line rail project.

The site, to the east of Canary Wharf and opposite London City airport, will now feature “retail, leisure and residential accommodation” a sales brochure said. The majority of the existing space remains vacant.

©2023 Bloomberg L.P.