May 3, 2023

Amazon ‘Aggregators’ Who Raised $16 Billion Are Now Teetering

, Bloomberg News

(Bloomberg) -- During the pandemic, Wall Street banks and private equity firms invested billions of dollars in startups rolling up popular brands sold on Amazon.com Inc. The bet was that these upstarts, fueled by an online sales boom, would become the next consumer product conglomerates — like Procter & Gamble or Unilever.

Then the pandemic ended, consumers returned to the stores, and Amazon’s sales growth cratered — erasing almost half of its market value. Now the reckoning has arrived for these so-called brand aggregators.

With names like Thrasio, Razor Group and Perch, the companies aren’t widely known but over the past few years have shelled out tens of millions of dollars for tea kettles, foot massagers, peppermint-based jock-itch remedies, medicine balls, magnetic eyeglass holders, air purifiers and more. To finance the buying spree, they raised $16 billion – mostly debt – from big names like JPMorgan Chase & Co., Goldman Sachs Group Inc., BlackRock Inc. and Bain Capital, as well as smaller investment funds.

Rising interest rates, higher costs and cooling online demand have pushed some of these upstarts to the edge, forcing them to seek debt relief or merge with one another, according to people familiar with the situation. There are so many aggregators and investors speaking with one another it’s difficult to predict which companies will emerge intact and which will get washed out.

The consolidation could ding some lenders, which might be forced to write down their investments, a hit that could collectively reach billions of dollars. BlackRock said in February that it wrote down the value of Razor Group, contributing to the investment firm’s fourth-quarter decline in assets. The alternative to writedowns could be even more painful: businesses that go broke trying to go it alone and can’t pay back anything at all.

“There’s a ‘Game of Thrones’ vibe around this entire industry,” said Juozas Kaziukenas, founder and chief executive officer of Marketplace Pulse, which monitors online sales and tracked the aggregators’ emergence. “There’s a lot of pride in these negotiations, like which company gets to keep the name and who will be CEO.”

Bloomberg interviewed more than 25 aggregators, investors and brokers to chronicle the travails of an industry that emerged from the shadows of Amazon just a few years ago and employs some 9,000 people around the globe. JPMorgan, Goldman Sachs, BlackRock and Bain Capital all declined to comment. Aggregators Thrasio, Razor Group and Perch also declined to comment.

Many aggregators were inspired by Anker Innovations Technology Co., which started out selling cheap phone chargers on Amazon and today sells a range of electronics online and in big-box stores like Walmart. Rather then spend years building brands from scratch as Anker did, the aggregators looked for ones that were already doing brisk business on Amazon.

The theory was that any combination of products could achieve economies of scale since almost all of the merchandise could be consolidated in shipments from China and sold on Amazon’s sprawling marketplace. Lenders encouraged the aggregators to borrow and buy with little oversight, betting the biggest would be in the best position to go public quickly.

Read more: Bidding Wars Break Out in Sizzling Market for Amazon Brands

The $16 billion that flowed into the nascent industry went to about 60 firms, according to Marketplace Pulse. Thrasio, the largest of them, raised $3.4 billion, including a $500 million round in 2021 that JPMorgan, Goldman Sachs, Bank of America Corp. and Morgan Stanley participated in. Berlin Brands Group, Razor Group, Perch and Heyday raised $1.3 billion, $1 billion, $908 million and $800 million respectively. Morgan Stanley declined to comment, and Bank of America didn’t respond to requests for comment.

The first warning signs emerged in 2021 as online spending cooled. Thrasio shook up management and delayed plans to go public with a blank check company. Other aggregators stopped buying brands and began gutting teams they’d just built. Costs rose, and some were forced to offer steep discounts to move merchandise.

It hasn’t helped, according to insiders, that aggregators tended to hire people steeped in dealmaking rather than selling online. “The assumption that any layman can run an e-commerce business is wrong,” said Michal Baumwald Oron, CEO of Fortunet, an investment banking firm serving online businesses. “The successful brands are run by smart professionals and so will the successful aggregators.”

In March, about 30 entrepreneurs representing 15 aggregators convened a private dinner in Las Vegas during the annual Prosper Show, which caters to online merchants. Over rib-eyes and chicken piccata at Scarpetta, an Italian restaurant in the Cosmopolitan, the group brainstormed strategies to weather the slump, according to four people who were there and requested anonymity to discuss a private matter.

Top of mind for the diners was the fact that many aggregators have breached financial requirements governing hundreds of millions of dollars in high-interest loans. That has prompted lenders to take a more aggressive role in their day-to-day operations.

The most immediate solution, according to people involved in the conversations, is for the aggregators to consolidate in exchange for more favorable loan terms. At the start of the dinner, one guest jokingly suggested locking the door until they’d agreed to form one big company. The crack smoothed the way for more serious conversations about negotiating with lenders, finding new funding sources and, most importantly, exploring potential partnerships.

Loan terms negotiated before the downturn could potentially hinder consolidation. Lenders put protections in place to prevent aggregators from selling their assets below a certain amount, much like a bank preventing the sale of a home for less than what’s owed on a mortgage.

Since many brands sold on Amazon are now less valuable, loan covenants will have to be revised for deals to go through, said John Fang, co-founder and managing partner at Two Roads Advisors, a boutique investment bank in New York that has worked on about a dozen aggregator transactions.

“We’re aware of these covenants, and we’re working with new money to structure around [the issue] without overpaying for assets,” Fang said.

“A lot of these aggregators are kind of like zombie companies just burning through cash unless their lenders are willing to take massive haircuts,” said one dinner attendee, who spoke on condition of anonymity because the conversations were private. “Everyone is kind of screwed at this point.”

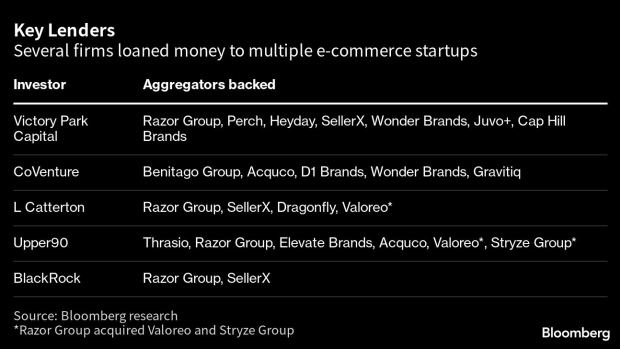

Victory Park Capital, a Chicago fund with $4.6 billion under management, invested in at least seven aggregators that raised a total of $3.85 billion. The fund is trying to unwind its exposure and is pushing some of its aggregators to merge, according to people familiar with the matter. Victory Park invested in Berlin-based Razor Group, which raised $1 billion and purchased smaller aggregators factory14, Valoreo and Stryze Group. Victory Park declined to comment.

Another lender seeking options is Miami-based CoVenture, which has $2 billion under management. It invested in five aggregators that raised a total of $738 million. The firm for months has been trying to sell pieces of Benitago Group, which raised $380 million, and Acquco, which raised $160 million, without success, according to people familiar with the matter. CoVenture declined to comment.

Benitago CEO Santiago Nestares said the company is no longer looking to sell its brands and is working to “maximize their value by keeping those brands within our portfolio.” Acquco didn’t respond to requests for comment.

“If you take two mediocre companies and put them together, that doesn’t really give you any efficiencies,” said one person involved in talks between aggregators and lenders. “I don’t think this shakeout is anywhere near done in terms of the fire sales that need to happen.”

In the meantime, talks are accelerating on multiple fronts:

- Perch, the fourth biggest aggregator, hired investment banking firm Houlihan Lokey Inc. to explore potential acquisitions several months ago and is in discussions with five potential targets including CoVenture-backed Acquco, according to people familiar with the matter. Houlihan Lokey didn’t respond to requests for comment.

- SellerX, a Berlin-based aggregator that raised $767 million, is in talks to merge with Elevate Brands of New York, which raised $592 million, according to people familiar with the matter. A combined company would be second to Thrasio in terms of overall funding raised. Elevate Brands declined to comment. SellerX didn’t respond to requests for comment.

- Minneapolis-based Suma Brands, which raised $150 million, is in talks to buy D1 Brands of New York in a distressed sale, according to people familiar with the matter. D1 Brands investors include CoVenture. The deal will be structured as a merger, according to a person familiar with the matter. Suma Brands and D1 Brands didn’t respond to requests for comment.

- Miami-based unybrands, which raised $325 million, has halted buying brands and is looking at other aggregators for a potential acquisition, according to people familiar with the matter. Unybrands declined to comment.

Thrasio, which snatched up more than 200 brands during its pandemic buying spree, is still retrenching. It has some wins, most notably the pet deodorizer Angry Orange now being sold at Walmart. But Thrasio also has to cull its underperforming brands to focus on profitability, according to people familiar with the matter. Its new CEO Greg Greeley spent almost 20 years at Amazon, a stint that included the dot-com bust of the early aughts and the Great Recession.

Razor Group, the third-largest aggregator, is attracting a lot of interest. In December, L Catterton, a private equity firm backed by Bernard Arnault, the world’s wealthiest man, led a $70 million round in the company. The infusion bankrolled Razor’s acquisition of Valoreo, a Mexico City-based aggregator.

L Catterton’s strategy is to pull together firms that have expertise with e-commerce players in different markets, such as Amazon in the US and MercadoLibre Inc. in Latin America, said Ramiro Lauzan, a partner at the private equity firm.

“Razor, in our view, is one of the emerging winners in this space,” Lauzan said. “They’re among the top three worldwide, alongside Thrasio and maybe one more.”

Upper90, among the first to invest in Thrasio back in 2018, is also betting Razor has bright prospects. “Some companies will go under,” said Billy Libby, Upper90’s co-founder and CEO. “And the bigger will keep getting bigger.”

(Updated with fresh dealmaking detail in third item of bulleted section.)

©2023 Bloomberg L.P.