Aug 20, 2019

Amazon Effect Helps Kohl's Help Itself

, Bloomberg News

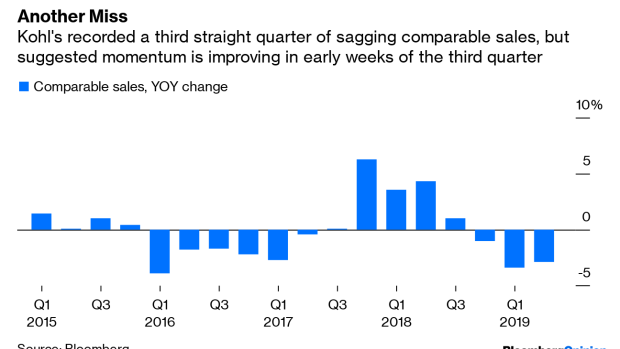

(Bloomberg Opinion) -- Look at some of the headline numbers in Kohl’s Corp.’s second-quarter earnings report, and you’d surmise that things are pretty grim for the department-store chain. Look at the text of the press release, though, and you’ll find bread crumbs of information that suggest it is turning the corner on its near-term problems.

Kohl’s comparable sales fell 2.9% from a year earlier. That’s a worse result than analysts had estimated – and their views of how the quarter would shape up had already darkened significantly after the retailer slashed its annual guidance back in May following a rough first quarter. On top of that, gross margin in the second quarter slipped to 38.8% from 39.5% a year earlier, likely reflecting efforts to be more competitively priced in its home-goods department after struggling in that area earlier this year.

Yet other details from Kohl’s results don’t paint such a gloomy picture. The company said comparable sales turned positive near the end of the quarter, rising 1% from a year earlier in the last six weeks of the period. CEO Michelle Gass also noted in the press release that improvement has continued into the early part of the third quarter, with back-to-school shopping off to an upbeat start.

Importantly, Kohl’s – unlike some of its competitors promising an imminent turn in momentum – has offered a plausible list of catalysts for continued progress. The company is adding several prominent brands to its lineup, including shoe label Nine West and an exclusive home-goods line from HGTV stars Drew and Jonathan Scott. It will also sell Elizabeth and James, a trendy clothing label by Mary-Kate and Ashley Olsen. By beefing up both its selection of familiar national brands as well as exclusive goods shoppers can’t get anywhere else, it is taking concrete steps to improve its merchandise selection.

It helps, too, that it has a new tactic for getting more shoppers to see those goods in the first place: Its recently-launched partnership with Amazon.com Inc. In July, the retailers rolled out nationwide a program in which Kohl’s brick-and-mortar stores accept customers’ returns of Amazon purchases. I am optimistic about what that arrangement can do for both companies. Kohl’s needs footsteps in its stores, and the Amazon partnership has provided just that in pilots in the Chicago and Los Angles markets. And, as I’ve noted before, it isn’t insignificant that Amazon fares better than Kohl’s with younger shoppers – potentially giving it access to a demographic that Gass has said the company needs to do a better job of reaching.

Gass said in the press release that she is “confident” that added traffic from the Amazon returns program will boost sales in the second half of the year, hinting the program is at least meeting the company’s expectations in its early weeks.

In some ways, Kohl’s could be said to be in worse shape than key rival Macy’s Inc., which at least managed to eke out narrowly positive comparable sales in the quarter and has guided for flat to slight growth on that measure for the year. Yet I’m still more optimistic about Kohl’s prospects for reinvention over the long haul.

The Amazon returns program is a far more promising driver of visits from new customers than anything Macy’s has put forward. Also, while both retailers have embraced a strategy of becoming more productive by shrinking certain store locations rather than closing them, I currently have more confidence in Kohl’s ability to make that approach successful. Kohl’s has more physical locations overall, but they’re largely in strip centers, not in enclosed malls that are structurally challenged. I suspect that makes it easier for Kohl’s to find ways to monetize that unneeded space, something it is already doing with arrangements with the likes of Aldi and Planet Fitness.

Like all department stores, Kohl’s still has much to do to prove it can thrive, not just survive, in today’s retail environment. A significant improvement in comparable sales in the third quarter – which now seems likely – would be a step in that direction.

To contact the author of this story: Sarah Halzack at shalzack@bloomberg.net

To contact the editor responsible for this story: Beth Williams at bewilliams@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Sarah Halzack is a Bloomberg Opinion columnist covering the consumer and retail industries. She was previously a national retail reporter for the Washington Post.

©2019 Bloomberg L.P.