Nov 18, 2021

Amazon Is Goldman’s Top U.S. Internet Stock Pick for 2022

, Bloomberg News

(Bloomberg) -- Amazon.com Inc.’s days as a stock market laggard are numbered, according to Goldman Sachs Group Inc.

After trailing the rest of its megacap technology peers this year, Amazon is poised to outperform in 2022 as it benefits from resurgent growth in a range of markets such as e-commerce, cloud computing and advertising, analysts including Eric Sheridan wrote in a note, making the stock their top pick among U.S. Internet names.

Goldman’s endorsement is the latest show of support for Wall Street’s most-loved megacap in a year in which Amazon failed to keep pace with the S&P 500 Index. The stock has gained nearly 10% in 2021 as it grappled with a re-opening economy, rising labor costs and supply chain disruptions. The benchmark index is up about 25%.

Despite two consecutive quarters in which Amazon missed revenue estimates, all 60 analysts tracked by Bloomberg that cover the stock have maintained their buy ratings. That level of bullishness is unmatched by Alphabet Inc., Apple Inc., Microsoft Corp. and Facebook parent Meta Platforms Inc.

“We see Amazon as a top pick on a 12-month view with an increasingly positive skew in its risk/reward after a pronounced period (16+ months) of share underperformance,” Sheridan and his colleagues wrote. Goldman’s $4,100 price target implies a gain of about 16% from current levels.

Powerful Earnings

The tech sector as a whole has held up well in the past two weeks, despite a spike in U.S. Treasury yields. Rising yields tend to discount the present value of future profits and higher rates put pressure on the shares of technology companies with high valuations.

A strong earnings season is one reason the sector has performed well, according to Peter Andersen, founder of Andersen Capital Management. “Yes, they are facing higher rates, but they also have higher earnings, so I don’t think there will be a catastrophic effect,” Andersen said in an interview.

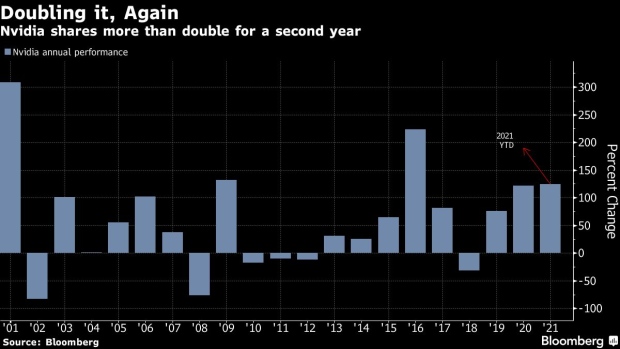

Nvidia Corp.’s record quarterly sales on Wednesday evening confirmed that trend. The world’s largest chipmaker by market value jumped 12% on Thursday after an expansion into data-center semiconductors helped bolster its sales forecast. The company also sees another big opportunity helping power the so-called metaverse -- a term for interconnected virtual worlds.

Tech Chart of the Day

Top Tech Stories

- Paytm’s market debut, India’s biggest-ever, turned out to be a disaster as the digital-payments provider’s shares sank 26%

- Nvidia gave a rosy forecast for sales in the fourth quarter, fueled by strong demand for its chips used in data centers

- Cisco Systems revenue forecast for the current quarter fell short of estimates, hurt by a shortage of components

- Amazon.com is considering shifting its popular co-brand credit card to Mastercard from Visa

- Chinese technology stocks were set for their worst day in three weeks after Baidu and Bilibili’s earnings

- An Apple engineer who created a protest movement on workplace issues is leaving after reaching a settlement

(Updates share moves throughout.)

©2021 Bloomberg L.P.