Apr 26, 2019

American Air falls as 737 Max grounding, fuel costs weigh on outlook

, Bloomberg News

American Airlines Group Inc. (AAL.O) dropped as the carrier cut its earnings forecast for this year, citing rising fuel costs and the worldwide grounding of the Boeing 737 Max.

-Parking the Max will reduce 2019 pretax profit by about US$350 million, the world’s largest airline said Friday as it reported quarterly results. American projected adjusted earnings of US$4 to US$6 a share, down from as much as US$7.50.

-Fuel expenses this year will be about US$650 million higher than forecast three months ago.

Key Insights

-The Max grounding, following two fatal crashes since October, wasn’t the only problem American had with its fleet. During the first quarter, it had to take 14 Boeing 737-800s out of service because of problems with the installation of overhead bins. The two issues forced American to cancel 2,140 flights during the period.

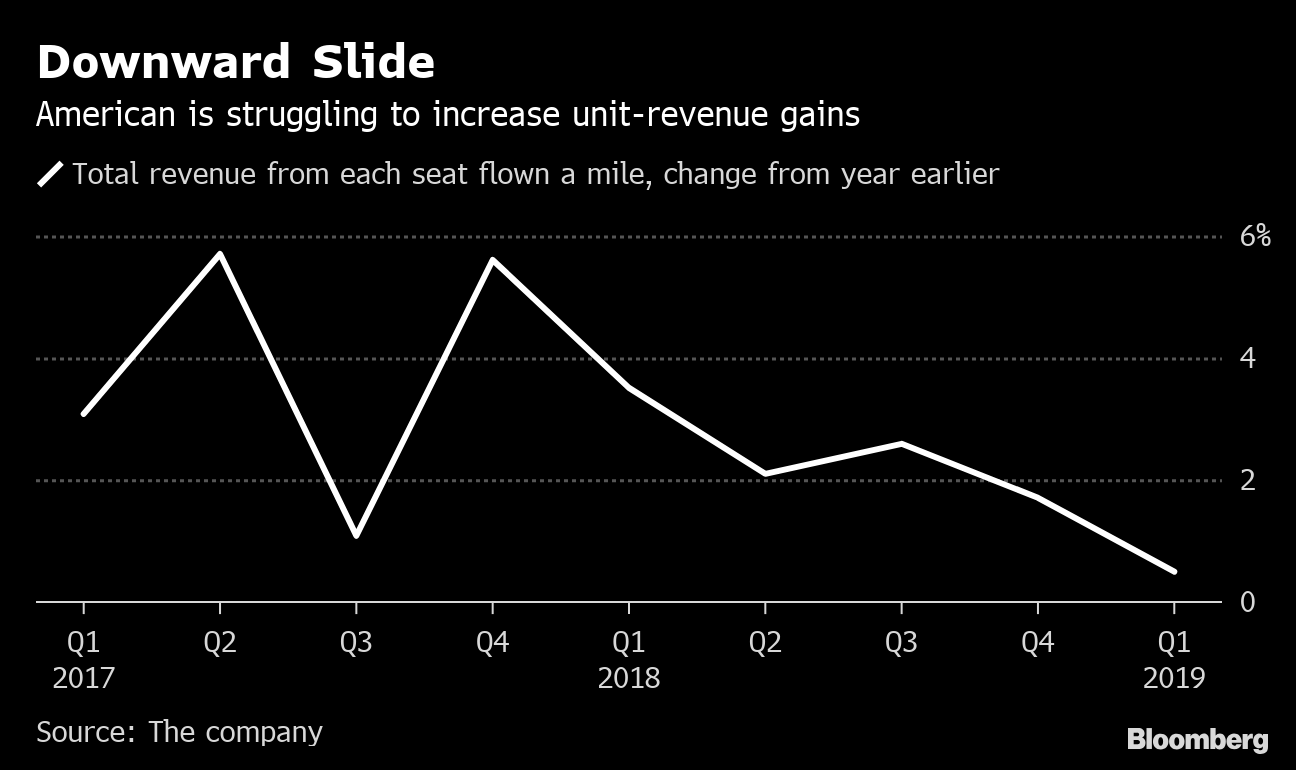

-American said it expects to maintain a grip over prices, forecasting that revenue from each seat mile flown will rise between 1 per cent and 3 per cent this quarter from a year earlier. The closely watched gauge of pricing power increased 0.5 per cent in the first quarter.

-American is banking on planned expansions at its three most profitable hubs through 2021, including this summer’s addition of 100 flights at Dallas-Fort Worth International. The flights “immediately have better-than-average profitability,” the carrier has said.

Market Reaction

-The stock slumped 3.6 per cent to US$32.22 before the start of regular trading in New York. American climbed 4 per cent this year through Thursday, trailing the 9.3 per cent advance of a Standard & Poor’s index of the five biggest U.S. carriers.