Nov 19, 2021

Amsterdam Hits IPO Record as Europe’s SPAC Capital

, Bloomberg News

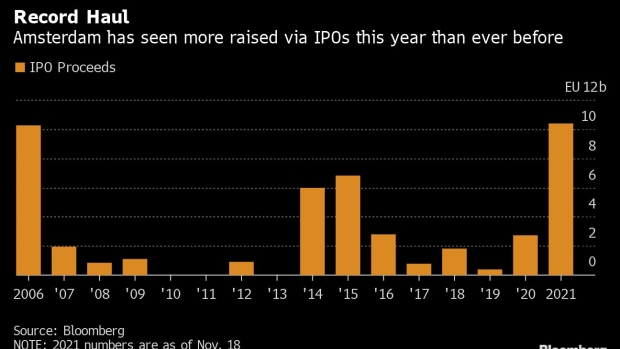

(Bloomberg) -- Amsterdam is enjoying a record year of initial public offerings, boosted by a flurry of blank-check listings that are eluding most exchanges in Europe.

The Dutch city, home to the world’s oldest stock exchange, has hosted 20 IPOs so far in 2021 for its highest-ever haul of 10.4 billion euros ($11.7 billion), according to data compiled by Bloomberg.

Businesses have flocked to Amsterdam as it usurped London as Europe’s premier share-trading center after Brexit. The Dutch exchange also attracted more special purpose acquisition companies than any other venue in the region, thanks to benign regulations and a deep pool of investors.

The latest is European Healthcare Acquisition & Growth Co BV, which made its debut Thursday. A total of 13 SPACs have listed in Amsterdam this year, including from big-name sponsors like UniCredit SpA’s former Chief Executive Officer Jean Pierre Mustier and billionaire Bernard Arnault.

“Amsterdam’s international orientation and an issuer-friendly and pragmatic regulatory framework, embedded in a high-quality financial ecosystem, are providing a perfect backdrop for SPAC IPOs,” said Paul Huysmans, global co-head of equity capital markets at ABN Amro.

London has struggled to lure large SPACs, meanwhile, even after overhauling its listing rules. And with the U.K.’s exit from the EU clouding its future as a global financial center, Amsterdam is increasingly challenging the City for business, especially from big continental issuers.

Read More: Frankfurt, Amsterdam Close In on London Top IPO Spot: ECM Watch

“Before Brexit, if you were a large cap in Europe, you would traditionally consider London, more than Amsterdam, or Paris as listing venues,” said Anthony Attia, global head of primary markets and post trade at Euronext NV.

Polish parcel-locker provider InPost SA chose the Netherlands for its January IPO, Europe’s largest in 2021. Others followed suit, including Luxembourg-based call center operator Majorel Group Luxembourg SA and CTP BV, a developer of industrial property in central and eastern Europe.

Still, London’s IPO market is by far the biggest in Europe with proceeds of 15.6 billion pounds ($21 billion). Its rivalry with Amsterdam deepened this week, as oil major Royal Dutch Shell Plc said it plans to drop “Royal Dutch” from its name, relocate its tax residence to the U.K. and move its top executives from The Hague to London.

(Corrects Anthony Attia’s title in seventh paragraph.)

©2021 Bloomberg L.P.