Aug 17, 2022

Analog Devices Falls After Warning of ‘Economic Uncertainty’

, Bloomberg News

(Bloomberg) -- Analog Devices Inc. shares fell as much as 5.8% after the chipmaker warned that the shaky economy has begun to affect orders, even as it delivered a better forecast than most analysts were anticipating.

“While economic uncertainty is beginning to impact bookings, demand continues to outpace supply, resulting in higher backlog,” Chief Executive Officer Vincent Roche said in a statement announcing fiscal third-quarter results.

Though Analog Devices is more upbeat than many of its chip peers, predicting a “banner year,” the remarks added to concerns about the industry. Intel Corp., Nvidia Corp. and Micron Technology Inc. all gave weak earnings outlooks over the last month, signaling that the market is headed into one of its periodic slumps.

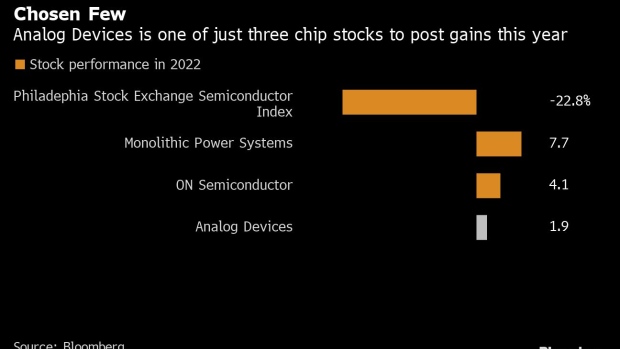

Analog Devices suffered its worst stock decline in about a month Wednesday, erasing its small gain for the year. The stock had outperformed most chipmakers in 2022, rising 1.9% through Tuesday’s close. The Philadelphia Stock Exchange Semiconductor Index, in contrast, fell nearly 23%.

Despite the chilly investor reaction, Analog Devices exceeded expectations with both its third-quarter results and forecast for the current period. Fourth-quarter revenue will be about $3.15 billion, the Wilmington, Massachusetts-based company said. Excluding certain items, profit will be about $2.57 a share. Analysts estimated sales of $3.1 billion and earnings of $2.50 a share.

“We’re very aware of the macro indicators and we’re playing it more conservative because of that, but we’re enjoying strong demand,” said Chief Financial Officer Prashanth Mahendra-Rajah. “We know we’re not going to be immune to this macro economic environment. But we’re not seeing the same level of softening as others.”

Mahendra-Rajah said orders rates declined toward the end of the last quarter, but the company was still getting more requests for products than it was shipping out.

Analog Devices specializes in analog and embedded computing components, a sector led by Texas Instruments Inc. Analog chips convert real-world things -- like sound and pressure -- into electronic signals. And the rush to add automation to factory equipment and buildings stirred new demand in recent years. The move toward battery-powered cars has also fueled the market.

Automotive revenue more than doubled from a year earlier, Analog Devices reported. Industrial-related sales surged 55%, and even the consumer segment -- its smallest unit -- posted growth of 136%. Overall, the latest quarter was the fourth in a row with sales growth above 50%.

Third-quarter revenue was $3.11 billion in the period, which ended July 30. That yielded a profit of $2.52 a share, excluding some items. Analysts estimates had called for sales of $3.05 billion and earnings of $2.44 a share.

(Updates with share reaction starting in first paragraph.)

©2022 Bloomberg L.P.