Nov 15, 2021

Analyst downgrades National Bank to sell despite higher dividend expectations

Barclays downgrades National Bank Financial to sell after stock rises 46% so far this year

National Bank of Canada might be a little bit too Canadian for its own good, according to one analyst.

John Aiken, who covers the Canadian financial services sector for Barclays, cut his rating on National Bank to the equivalent of a sell from hold Monday. The downgrade was made “largely based on valuation concerns,” Aiken told clients in a report, noting National Bank shares are up more than 46 per cent since the start of 2021 versus an average 31 per cent year-to-date rise in the value of Canada’s five largest banks.

“Operationally, we have no issue with National’s strategy and what it has accomplished,” Aiken said. “However, after an impressive run, we do not believe that its relative valuation reflects its outlook as a largely domestic bank.”

While the Montreal-based bank’s exposure to Cambodia “has been a standout positive,” Aiken said it remains a small contributor to overall earnings. Combined with “some uncertainty” surrounding National Bank’s plans to expand its Credigy platform in the United States, the Barclays analyst concluded that a “lack of broader diversification away from Canada” could become a headwind.

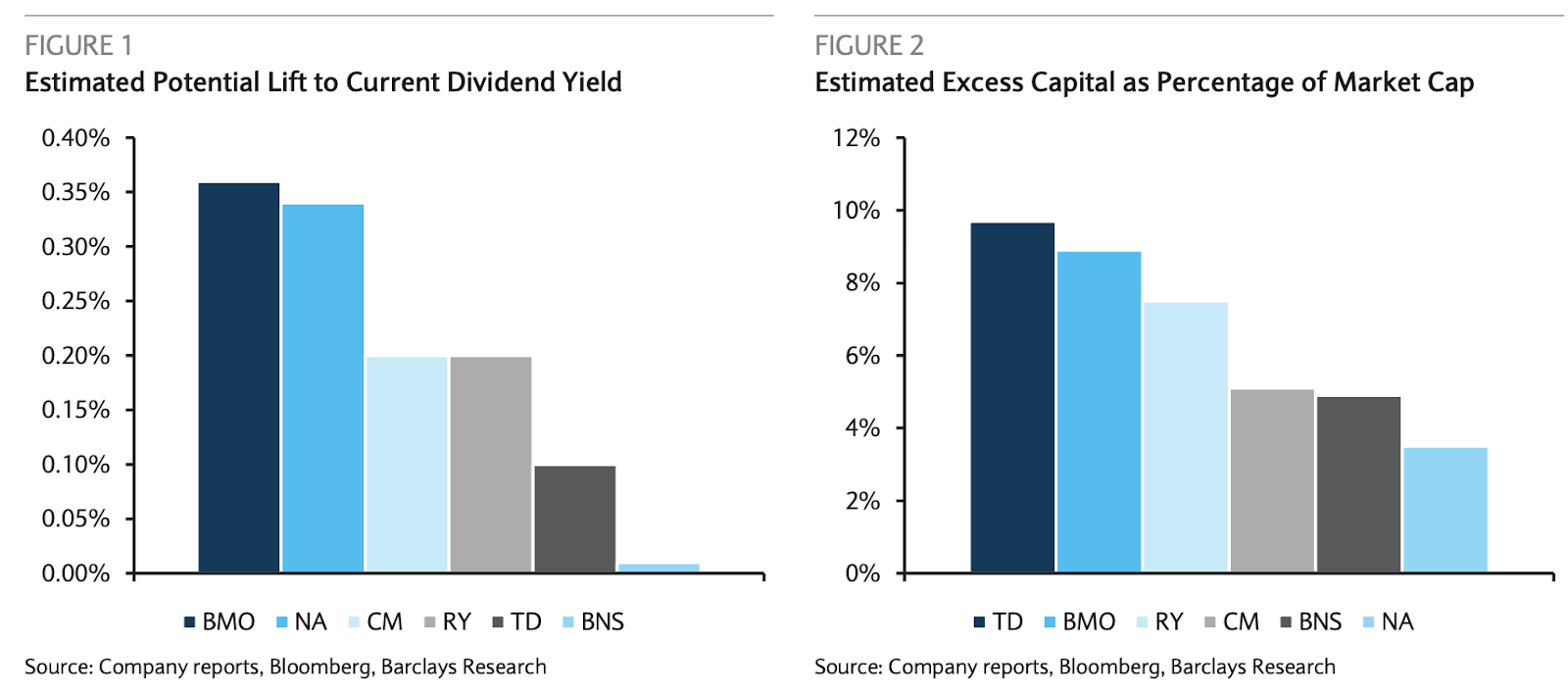

Amid expectations for a “cornucopia” of dividend increases and share buybacks after Canada’s banking regulator removed pandemic-related capital restrictions earlier this month, Aiken said “National has the ability to generate the second-highest lift to its dividend yield” after Bank of Montreal.

“However, when capital is viewed in terms of relative amount of excess, National lags its peers,” Aiken said, noting higher dividends are already “currently captured” by the bank’s share price. “This represents a lower level that can be returned to shareholders or deployed into avenues for growth.”

Another potential source of uncertainty Aiken noted for National Bank is the possibility of a change in strategic direction at the top. Laurent Ferreira, who has been with National Bank for more than two decades and was most recently chief operating officer, took over as CEO on Nov. 1 after Louis Vachon retired following 14 years in that role.

“While the new strategies could be viewed positively or negatively by the market,” Aiken said, “it does present some relative uncertainty that has not existed for National for some time.”