Jan 20, 2019

AngloGold Faces South African Dilemma as M&A Gold Rush Quickens

, Bloomberg News

(Bloomberg) -- Two decades ago, Anglo American Plc created the world’s No. 1 gold miner by merging its South African assets. Having long since been eclipsed by its rivals, AngloGold Ashanti Ltd. may need to leave home to keep up.

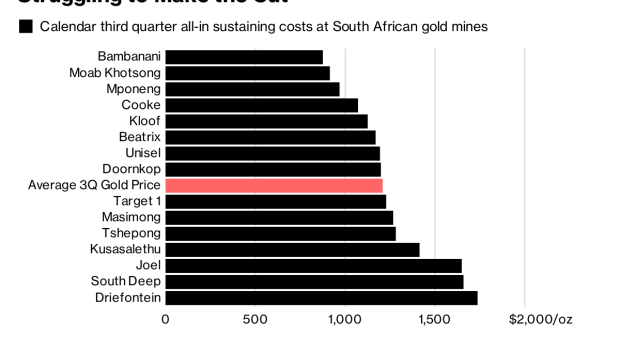

Newmont Mining Corp. and Barrick Gold Corp. have forged mega deals that will extend their lead over AngloGold. Saddled with Mponeng, the world’s deepest mine in a dying South African industry that’s struggling to contain costs, the third-biggest producer could boost its value by leaving the country, according to Rene Hochreiter, analyst at Noah Capital Markets in Johannesburg.

“Their best bet is to get out of South Africa and leave Mponeng behind,” he said. “The costs never come down in South African gold.”

That would be the final step in AngloGold’s gradual withdrawal from South Africa. The country contributed just 14 percent of its output in the third quarter of last year, down from 26 percent a year earlier, after the company sold and shut mines to stem losses.

Now AngloGold is considering hiving off its South African operations and listing in London or Toronto, people familiar with the matter said last month. Listing in London would give the company exposure to a big pool of investors with very few options to buy into gold equities, following Barrick’s acquisition of Randgold Resources Ltd.

A spokesman for AngloGold declined to comment.

To exit South Africa, the company would need to offer a steep discount on its assets, said Leon Esterhuizen, an analyst at Nedcor Securities Ltd. That still wouldn’t be enough to interest international companies.

“They are not going to invest here,” Esterhuizen said. “Whether it’s AngloGold or anybody else in South Africa gold, it makes sense to go and find other places to make money.”

That leaves other South African producers as potential acquirers. The biggest, Sibanye Gold Ltd., is preoccupied with its acquisition of platinum miner Lonmin Plc, while Gold Fields Ltd. is focused on turning around its sole South African mine, which has been unprofitable for a decade.

AngloGold Chief Executive Officer Kelvin Dushnisky is looking to sell non-core assets to unlock value, but he’s said it’s too early to take a decision on South Africa. If the company’s scaled-down operations can generate free cash flow, then perceptions about the country might change, he has said.

Partly benefiting from the turnaround work of his predecessor, the new CEO has seen AngloGold shares rally 48 percent since he took over in September. Barrick has climbed 18 percent and Newmont just 1.8 percent over the same period.

Further gains may be tempered by the difficult jurisdictions -- including Tanzania and the Democratic Republic of Congo -- in which the miner operates, said James Bell, an analyst at RBC Capital Markets. Indeed, given the challenges facing AngloGold, the company should be in no rush to exit South Africa if it can make those operations profitable, he said.

The company may be interested in buying some of the assets being spun off by Barrick and Newmont, but Bell doesn’t think it will be part of a larger wave of industry consolidation.

“AngloGold is not a takeover target,” he said. “It’s a very large complicated business and has exposure to jurisdictions which are quite tough for other companies to be comfortable in.”

To contact the reporter on this story: Felix Njini in Johannesburg at fnjini@bloomberg.net

To contact the editors responsible for this story: Lynn Thomasson at lthomasson@bloomberg.net, Dylan Griffiths, Liezel Hill

©2019 Bloomberg L.P.