Jun 27, 2022

Angst Over US Inventory Pileups Is Belied by Still-Solid Sales

, Bloomberg News

(Bloomberg) -- A pileup of unsold goods at big-name retailers Target Corp. and Walmart Inc. stirred concerns about an economy at risk from an inventory overhang. But, for now, solid demand is helping soothe some of that anxiety.

Inventories rose an annualized $343 billion in the last two quarters, the biggest back-to-back build in government data back to 1999. Yet stockpiles are less concerning when compared with the total value of sales.

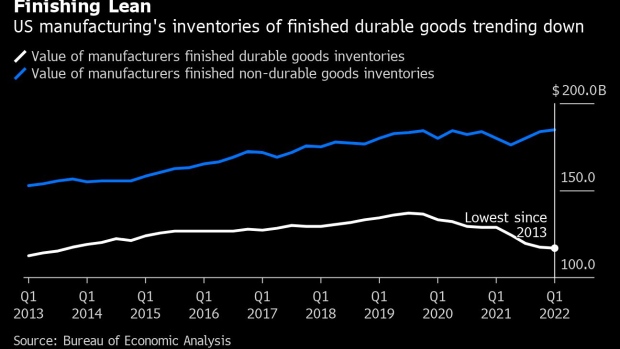

For instance, while the inflation-adjusted retail inventory-sales ratio in March was the highest in a year, it’s still well below the average over the last 10 years. And though the ratio for manufacturers has moved up, a closer examination shows that the value of unsold finished durable goods at the lowest level since 2013.

“Overall inventories in the economy are still unusually low, even after a few quarters of substantial builds,” said Stephen Stanley, chief economist at Amherst Pierpont Securities. “That reflects how lean inventories were after massive liquidation during the pandemic.”

Should demand slow “abruptly, then inventories could become excessive, but, for now, we are far from that point,” Stanley said.

To be sure, there is some concern that households will temper their spending on merchandise in the face of faster inflation and as Americans shake off the pandemic by using more of their discretionary income for service-related expenditures.

Nonetheless, consumers have ample financial firepower to keep spending, according to Federal Reserve Bank of St. Louis President James Bullard.

Households “are flush,” Bullard said Friday in a speech in Zurich. “They have still $3.5 trillion of kind of Covid aid that is more or less unspent” which is “something on the order of 10% of GDP still sitting in people’s bank accounts.”

Late last year into early 2022, many companies scrambled to ensure warehouses and shelves had enough merchandise to meet robust consumer demand against a backdrop of uncertain supply networks.

Efforts by Target and Walmart help explain government data showing stockpiles at general-merchandise stores running 1.17 times sales, the highest since 2013. Still, inventory-sales ratios at other retailers remain well below their longer-term average.

Beyond retailers, manufacturers have also been busy proactively building stockpiles as they face the same uncertain supply chains. While the inventory-sales ratio is higher than it was before the pandemic, government data show the value of finished durable inventories at its lowest level since 2013.

Some unattributed comments from respondents in the latest Kansas City Fed manufacturing survey hinted at concern about the level of stockpiles firms are facing, though for different reasons.

What Midwest Manufacturers Say...

“Expecting a big decrease in sales the last half of the year. Appears our customers over ordered and have excess supply in the near term.”

“Input inventory is at an all-time high -- we’ve got a lot invested in inventory, but all it takes is one missing part to stop vehicle production.”

“Lack of availability and shipping problems is most evident currently in manufacturing supplies and equipment replacement parts.”

Indeed, manufacturers of big-ticket goods appear to be struggling to ensure they have the materials and supplies necessary to produce finished goods. Makers of non-durable merchandise such as apparel, petroleum products and chemicals are having greater success.

Institute for Supply Management data show that nearly half of manufacturers surveyed viewed their customers’ inventories as too low in May, the highest in six months, which could underpin future production growth. Only makers of apparel said stockpiles among their customers were too high.

©2022 Bloomberg L.P.