Jul 12, 2019

AB InBev shelves planned US$9.8B Asia Pacific unit IPO

, Bloomberg News

AB InBev's Hong Kong IPO Faces Potential Delay on Pricing Struggle

Anheuser-Busch InBev NV suspended what would have been the year’s largest initial public offering, citing market conditions for pulling plans for its Asia Pacific unit to raise as much as $9.8 billion.

The world’s biggest brewer said in a statement that it has decided for now not to proceed with the IPO of Budweiser Brewing Company APAC Ltd. People familiar with the matter said earlier that the company was struggling to price its shares in Hong Kong on Friday.

“The company is not proceeding with this transaction due to several factors, including the prevailing market conditions,” AB InBev said in the statement. “The company will closely monitor market conditions, as it continuously evaluates its options to enhance shareholder value, optimize the business and drive long-term growth, subject to strict financial discipline.”

AB InBev’s American depositary receipts fell as much as 4.9 per cent, closing down 3 per cent to US$86.94 in New York trading.

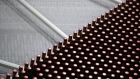

While the beer business has gone flat globally, it’s been booming in parts of Asia. AB InBev, the maker of Stella Artois, Corona and Hoegaardenhad, seen splitting off one of its growth motors as a way to woo local partners. A separate Asian unit would have made it easier to form tie-ups involving shareholdings and stake swaps in a region where revenue has almost quintupled this decade.

China’s Brewers

Budweiser Brewing APAC, which was seen as possibly achieving a market value to rival Heineken NV, is the biggest foreign brewer in China and trails only China Resources Beer Holdings Co., maker of the country’s Snow brand, the top-selling brew by volume.

Budweiser Brewing APAC’s decision to halt its share sale comes after Swiss Re AG announced on Thursday it was suspending an IPO of its US$4.1 billion ReAssure Group Plc unit, citing weak investor demand.

AB InBev’s Asia unit was offering 1.63 billion shares in its IPO at HK$40 to HK$47 each, its prospectus shows. That range valued the unit at 28.5 to 33.5 times consensus 2020 earnings, above the ratios for both Heineken and Carlsberg A/S.

Hoai Ngo, a senior credit analyst at Bloomberg Intelligence, said expectations had been “a little too lofty” for the listing.

“We thought the valuations they gave in the range were too high to begin with,” Ngo said. “When they were pricing the IPO with a mid-twenties multiple, it was probably a little bit too high.”

JPMorgan Chase & Co. and Morgan Stanley were leading the offering. One goal of the IPO was to pay off some of AB InBev’s US$108 billion in debt.

Uber No. 1

The IPO -- even at the bottom of its targeted range -- would have topped Uber Technologies Inc.’s US$8.1 billion listing, which remains the biggest globally this year.

IPOs in the U.S. remain on track for the best year since 2014, with more than US$32 billion raised in 95 listings, according to data compiled by Bloomberg. The U.S. surge was driven largely by so-called tech unicorns, startups valued at US$1 billion or more, many of them going public after years of investor anticipation. Those companies included Uber’s smaller ride-hailing rival Lyft Inc., with its US$2.34 billion listing in March, and the image-sharing website Pinterest Inc., which raised US$1.64 billion in its IPO.

Globally, 668 IPOs have raised US$86 billion this year. That’s less than half of the totals in 2018 and 2017.

The Budweiser Brewing APAC IPO would have almost doubled the amount raised in 87 other Hong Kong listings this year. This year’s total of US$10.6 billion, meanwhile, is unlikely to approach last year’s US$37.6 billion mark, the highest since 2010.