Dec 28, 2018

Another Reason to Be Bullish on Palladium: The Hybrid Car Boom

, Bloomberg News

(Bloomberg) -- Palladium, this year’s hottest metal, is used mainly to cut pollution from gasoline engines. Yet anyone betting the rise of electric vehicles will curb demand anytime soon is likely to be disappointed, according to the metal’s top producer.

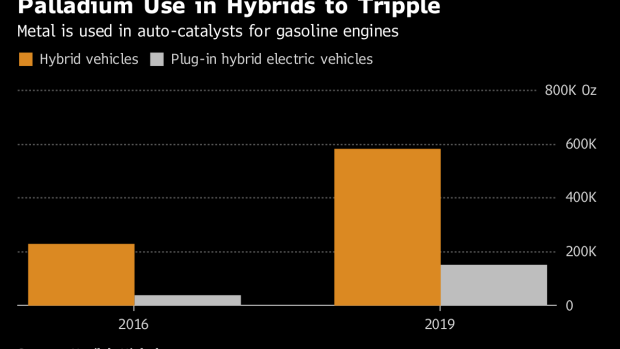

Hybrid-electric cars, which also require precious metals to control pollution, represent a growing percentage of future demand, said Anton Berlin, head of analysis and market development at Norilsk Nickel PJSC. The Russian miner forecasts that combined palladium use in hybrid and plug-in hybrid -- or rechargeable -- vehicles next year will be nearly triple that of 2016.

Read more: Year’s Best Major Metal Gains Steam as Supply Eclipses Trade Woe

Norilsk’s not the only one forecasting hybrid growth, at least in the medium term. While the projected increase in electric vehicles is significant, “it doesn’t compare” to the kind of expansion expected in hybrid electrics, JPMorgan Chase & Co. said in an October report. Hybrids are forecast to grow from just 3 percent of global market share in 2016 to 23 percent of sales by 2025, it said.

Palladium has gained 19 percent this year, and set successive records this month to at times surpass gold as the most valuable major metal. Demand is projected to exceed supply for the seventh straight year in 2018.

There’s some expectation that the rising cost of palladium may prompt automakers to look for ways to use more of its sister metal, platinum, which is used widely in diesel engines. However, Berlin said he doesn’t expect much substitution any time soon. The shift takes time and may not be economically viable, he said.

Some analysts are also forecasting a decline in palladium prices next year. The positive demand outlook is already reflected in the price, which has overshot, according to Georgette Boele, coordinator of FX and precious metals strategy at ABN Amro Bank NV.

Read a Quicktake on palladium’s surge to topple gold

Still, the demand outlook remains rosy. The number of cars carrying a platinum-group-metal-containing catalyst will probably grow from almost 76 million to almost 90 million in 2025, according to Carsten Menke, commodity strategist at Julius Baer Group Ltd.

“PGM demand in general and palladium demand in particular should continue to grow over the next six years.”

--With assistance from Ania Nussbaum.

To contact the reporters on this story: Yuliya Fedorinova in Moscow at yfedorinova@bloomberg.net;Rupert Rowling in London at rrowling@bloomberg.net

To contact the editors responsible for this story: Lynn Thomasson at lthomasson@bloomberg.net, Liezel Hill, Dylan Griffiths

©2018 Bloomberg L.P.