Sep 18, 2019

Apple Is Suffering an Identity Crisis With Consumers in China

, Bloomberg News

(Bloomberg) -- The trade war is taking its toll on Apple Inc., a new survey of Chinese consumer attitudes shows.

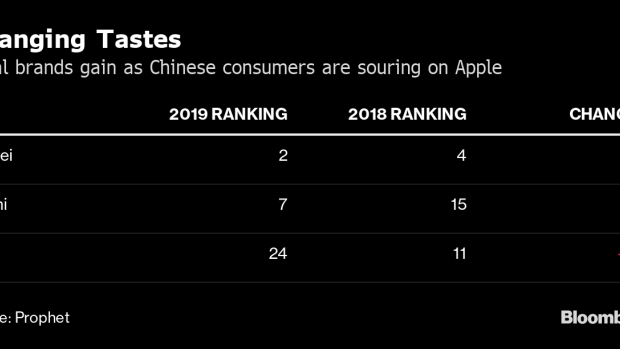

The company tumbled to No. 24 in an annual report on China’s top brands, falling from No. 11 a year ago. In 2017, before the trade war started, Apple was fifth in this ranking. Meanwhile, Apple’s biggest local rival, Huawei Technologies Co., climbed two spots and came in second, behind only Chinese payment service Alipay.

The shuffle in the rankings is a sign of the growing challenge American brands face in the second year of Donald Trump’s tariff showdown with his Chinese counterpart, Xi Jinping. The survey findings show Chinese consumers growing cooler towards some American brands, especially after Huawei saw its Chief Financial Officer, Meng Wanzhou, arrested in Canada last year at the behest of the U.S. government.

Trump followed with a ban on Huawei products, which helped fuel a surge of local support for the Shenzhen-based brand, according to Jay Milliken, senior partner in Hong Kong with Prophet, the San Francisco-based consultancy that conducted the survey of 13,500 Chinese consumers.

‘Nationalistic Buying’

“There’s a lot of nationalistic buying in that category, because Chinese consumers interpreted what happened to Huawei as an attack,” he said.

Patriotism helped fuel the rise of other Chinese brands, too. Sportswear maker Li Ning Co. cracked the top 40 for the first time, ranked No. 34, just two spots behind market leader Nike Inc.

Named after its founder, the famous gymnast, Li Ning capitalized on nationalistic sentiments of many Chinese consumers with the launch last year of a China Li-Ning collection at New York Fashion Week that heavily used red and yellow, China’s national colors.

There were only two American names in the top ten this year -- Android at No. 3 and Intel at No. 9 -- compared to five in the 2017 survey.

Switching Allegiances

Unlike Apple, Android and Intel don’t have to worry about consumers switching allegiances to local competitors, Milliken said, and that explains why they manage to remain highly ranked.

“Some Western brands are so integral in the lives of Chinese consumers, they’re almost predisposed to not losing relevance,” he said. “There are no Chinese alternatives so those remain super relevant.”

Geopolitical tensions aren’t the only problem Apple faces in China, its biggest market after the U.S.

While Beijing is pushing to make the country a leader in the introduction of high-speed 5G networks, Apple’s phones, even the newly announced iPhone 11, don’t support that latest wireless standard.

Prophet’s survey, conducted annually, asks Chinese consumers in large cities to rank 258 brands across 27 categories.

To contact the reporter on this story: Bruce Einhorn in Hong Kong at beinhorn1@bloomberg.net

To contact the editors responsible for this story: Emma O'Brien at eobrien6@bloomberg.net, Bhuma Shrivastava, Rachel Chang

©2019 Bloomberg L.P.