Aug 13, 2020

Applied Materials gives bullish sales forecast on rising orders

, Bloomberg News

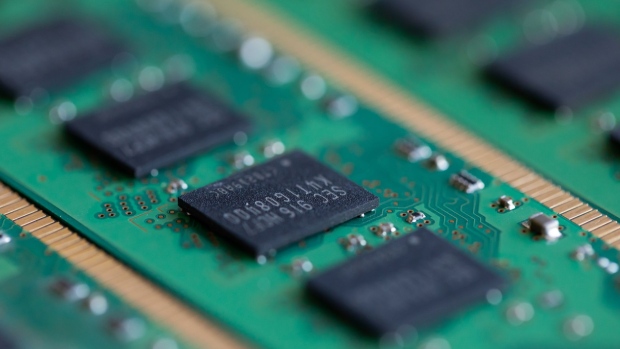

Applied Materials Inc. gave a bullish forecast for the current period on increasing orders for equipment used by makers of computer chips.

The Santa Clara, California-based company is the largest maker of machinery used to manufacture chips, the most important parts of the electronics supply chain. Its customers include Samsung Electronics Co., Taiwan Semiconductor Manufacturing Co. and Intel Corp. Chip equipment takes months to make and even longer to install and test in production lines that cost billions of dollars, which makes Applied Materials’ results and forecasts important early indicators of future demand in the electronics industry.

Key Insights

- Revenue in the fiscal fourth quarter will be about US$4.6 billion, the company said Thursday in a statement. Analysts, on average, estimated US$4.36 billion, according to data compiled by Bloomberg.

- Profit, on an adjusted basis, will be US$1.11 to US$1.23 per share in the three-month period ending in October, Applied Materials said. That compares with an average estimate of US$1.02.

- Fiscal third-quarter net income was US$841 million, or 91 cents a share, compared with US$571 million, or 61 cents a share, a year earlier, the company said. Revenue gained 23 per cent to US$4.4 billion in the period ended July 26. Analysts were looking for US$4.18 billion.

- Adjusted profit was US$1.06 a share in the quarter compared with analysts’ average estimate of 95 cents.

Executive Comments

The company is projecting spending on chip-making equipment will rise this year and that growth will continue next year.

“Semiconductor equipment demand is strengthening,” Chief Executive Officer Gary Dickerson said on a conference call with analysts. “Based on what we’re hearing from our customers we believe growth will be sustained in 2021.”

Applied Materials is operating at pre-Covid levels of productivity, he said.

The company can raise its profitability to previous historical highs over time, Chief Financial Officer Dan Durn, told analysts.

Stock Reaction

Shares gained about 3.3 per cent in extended trading. The stock closed at US$65.07 in New York, leaving it up 6.6 per cent this year.