May 9, 2021

Archegos Collapse Helps China Hedge Fund to 120% Gain This Year

, Bloomberg News

(Bloomberg) -- A China-focused hedge fund led by a 30-year-old who started trading as a teenager returned 120% in the first quarter, thanks in part to the unraveling of Bill Hwang’s Archegos Capital Management.

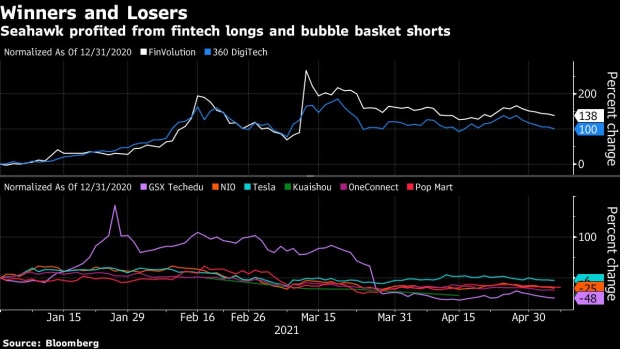

Bullish bets on a pair of Chinese fintech consumer lending platforms accounted for more than half of the quarterly return for Henry Liang’s Seahawk China Dynamic Fund, he said in a telephone interview. Additional gains came from wagers against a “bubble basket” of over-hyped new-economy companies, including GSX Techedu Inc., the Chinese after-school online tutoring firm later caught up in the Archegos-induced selloff.

The profits more than doubled the fund’s assets to nearly $700 million. Liang has given back $120 million to investors this year to manage the pace of asset growth and maintain performance. A Bloomberg index tracking hedge funds of all strategies advanced 4.6% in the first quarter.

Unburdened by the scrutiny of more risk-averse institutional investors, Seahawk was able to make concentrated bets for its ultra-rich mainland Chinese and Hong Kong clients, including Liang’s long-time followers since his university days. His approach highlights how foreign asset managers with lower risk appetites have been struggling to woo wealthy Chinese customers, who are willing to stomach short-term losses for outsized gains.

Read more on the struggles of global asset managers in China

Seahawk began to buy shares in FinVolution Group in the third quarter of 2019 and 360 DigiTech Inc. in the first quarter of 2020, adding more throughout the year when their stock prices were languishing.

Liang is betting that the Shanghai-based duo has an edge in risk management that will help them emerge as winners from the multi-year Chinese crackdown on internet lending.

The regulatory tightening has resulted in the demise of online peer-to-peer lending platforms that once numbered 5,000, according to data from the China Banking and Insurance Regulatory Commission. FinVolution and 360 DigiTech operate in a different space, using technology to connect borrowers and financial institutions.

Their share prices have at least doubled this year. Seahawk is now among FinVolution’s largest shareholders with a 13.5% stake at the end of February, according to data compiled by Bloomberg.

Bubble ‘Stretched’

In February, Seahawk dramatically boosted bearish bets against the “bubble basket,” including electric vehicle makers Tesla Inc. and Nio Inc., GSX Techedu, fintech firm OneConnect Financial Technology Co., toymaker Pop Mart International Group Ltd. and short-video platform operator Kuaishou Technology, Liang said.

The “new-economy bubble has been stretched to an unprecedented level, where valuation of quite a few internet and consumer stocks can hardly be justified even with the wildest 10-year assumptions,” he wrote in his first-quarter newsletter.

The collapse of Archegos led its prime brokers to dump shares including GSX Techedu. That contributed to the stock’s more than 80% tumble from this year’s peak, accelerating gains for Liang.

Seahawk has largely covered the new-economy shorts while barely trimming its bullish wagers on FinVolution and 360 DigiTech, even when the two fintech firms have fallen at least 30% from this year’s peaks in mid-March.

The Chinese antitrust clampdowns could benefit smaller players, especially fintech giant Ant Group Co.’s strongest second-tier rivals that aren’t part of larger platforms, Liang said.

His optimism isn’t shared by everyone. Jefferies Financial Group Inc. analysts expect growth of second-tier fintech platforms to slow now that China’s policy makers are seeking to curb household leverage rather than encourage consumer borrowing. China now also requires platforms to obtain licenses to collect data for personal credit reports that they provide to banks for higher fees, and new rules limit behavioral data collection, the analysts wrote in a note.

Pocket Money

A Guangzhou native who is now based in Hong Kong, Liang began to trade stocks at 13, with pocket money from his parents. In his final year in high school, he began to manage assets for clients who found him through word of mouth. By the time he shut those accounts to join a Goldman Sachs Group Inc. long-short equity hedge fund as an analyst, he was overseeing $9 million with a nearly 25% annualized return over six years, he said.

He started Seahawk in October 2017. Marketed as a macro fund, it has the flexibility to invest in all asset classes ranging from stocks and credit to currencies and derivatives. Liang sees the vanishing breed of bold investors including George Soros, Stanley Druckenmiller and Julian Robertson as his role models. When investors dumped the high-yield dollar-denominated bonds of Chinese property companies during the March 2020 market correction, he swooped in to buy, pocketing a gain of almost 20% that month.

It hasn’t all been smooth sailing. The fund lost 11% in 2019, according to a newsletter.

“We are naturally very contrarian,” Liang said. “We are embracing volatility.”

©2021 Bloomberg L.P.