Aug 2, 2022

Argentina Is Running Out of Cash Needed to Stave Off Devaluation

, Bloomberg News

(Bloomberg) -- Even in Argentina, a country whose very name has become synonymous with financial crisis, the current moment is dire.

With inflation hurtling toward triple digits and, economists say, just a policy mistake or two away from setting the stage for hyperinflation, the central bank is desperately trying to avert a peso devaluation that would only trigger another wave of price hikes.

Each day, the bank dispatches its traders to sell dollars and buy pesos that no one wants. On average, they’re burning through $60 million a day. For now, that’s kept the peso mostly steady in the primary foreign-exchange market.

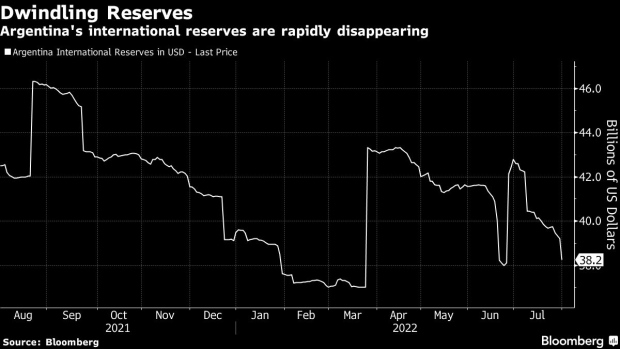

The problem is that their foreign reserves — the hard currency that serves as an emergency stash to protect a country from financial ruin — are now so low that no one can really tell just how much more they can spend. Just last week, the nation hemorrhaged $1.47 billion even as President Alberto Fernandez handed sweeping powers to a newly appointed economy minister to set things right. By some accounts, policy makers have already blown through all the easy-to-spend reserves they had on hand, leaving them scrambling to come up with ways to turn illiquid assets into cash.

The central bank’s public data is too opaque to decipher how exactly it’s drawing on the various piles of money that make up its reserves, and officials are mum on the topic.

What is known is this: There’s little chance of getting financial help from abroad. Foreign bond investors -- who have already pushed down the price of Argentina’s overseas bonds to about 20 cents on the dollar -- are too scarred by a string of past defaults to lend the country money now. The International Monetary Fund is unlikely to step in this time either. It’s already committed some $44 billion to the country and is showing no interest in pledging more capital.

All this means that local traders are positioning for a major devaluation. They drove the peso to as low as 335 per dollar last month in the parallel, unofficial market where it trades free from government intervention, some 60% weaker than the 130-per-dollar rate in the official market. A devaluation of that magnitude, economists say, could potentially spark an immediate surge in prices of up to 30% on essential goods such as foods and even bigger increases for fuel, deepening the financial pain that Argentines have been enduring for years.

“The problem is we have never had such a weak real exchange rate, nor such a wide gap between the official and parallel rates, while reserves were this low,” said Emiliano Anselmi, an economist at brokerage Portfolio Personal Inversiones. “The government won’t be able to hold out much longer without a one-off devaluation.”

In a bid to contain the crisis, Fernandez named House Speaker Sergio Massa as economy minister last week, giving the former cabinet chief and veteran politician an expanded portfolio and a mission to fix the economy. Massa, who will be sworn in Wednesday after his predecessor lasted just three weeks, will face deep political divides paralyzing Argentina’s left-leaning ruling coalition, not to mention global investors yanking money out of emerging markets as the Federal Reserve jacks up interest rates.

Read More: Argentina’s ‘Super’ Economy Minister Faces Mounting Crisis Ahead

Out of Cash

As money leaves Argentina, the country’s reserves provide a last line of defense for the peso. Most estimates place Argentina’s so-called net reserves -- its assets on hand, minus the money it owes -- at about $2 billion, with some economists estimating even less.

More than half of the money on the central bank’s balance sheet is held in credit swap lines with China and the Bank of International Settlements. Gold accounts for a small portion. Most of the rest -- about $12 billion -- come from savers’ bank deposits.

The central bank declined to comment on the exact composition of its $38 billion in gross reserves or what money it uses to support the peso. It says it keeps adequate foreign currency on hand to sustain normal economic growth and maintain a balanced foreign-exchange market.

Fears of the government’s insolvency are so acute that savers rushed to yank dollars from their bank accounts last month. Dollar deposits fell to their lowest since 2016 as Argentines withdrew almost $750 million.

“People are quick to react in times of market stress,” said Pablo Waldman, a senior strategist at Inviu in Buenos Aires. “They prefer to stash their savings under the proverbial mattress.”

Dire Straits

To be sure, Argentina has gotten by on less before, with total reserves dipping as low as $37 billion in March before the nation reached a new deal with the IMF. There’s also hope Argentina could get a flood of dollars if it can persuade soy farmers to sell some $13.4 billion of their beans sitting in storage, instead of waiting for a more favorable exchange rate.

Investors are optimistic that Massa will have a better chance of shoring up the economy than his predecessor, Silvina Batakis.

“Massa is an upgrade,” said Graham Stock, a senior emerging-market sovereign strategist at Bluebay Asset Management in London.

Still, there may be only so much he can do. Devaluing the currency would stoke inflation that’s already above 60%, but trying to keep it near its current levels will be a challenge given the lack of dollars in the country. The government needs to trim spending, but that risks undermining popular support.

“The central problem remains that there is no easy solution to the crisis,” Stock said. “High inflation is making the government unpopular and driving capital flight.”

©2022 Bloomberg L.P.