Jun 14, 2019

Argentina’s Rally Is ‘Too Far, Too Fast’ After a Blockbuster Week

, Bloomberg News

(Bloomberg) -- For some investors, this week’s spectacular gains in Argentine assets are too good to be true.

The stock market trounced global peers, while the peso, a perennial loser in recent years, was among the world’s biggest gainers. Moreover, the nation’s sovereign bonds had one of their best performances of the past decade.

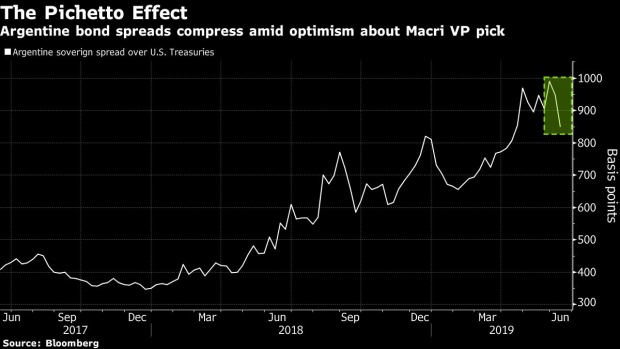

Assets soared after President Mauricio Macri tapped moderate opposition leader Miguel Pichetto as his running mate, potentially expanding his voter base before October elections, while data showed inflation slowing for a second month. Some investors were unimpressed, warning that the inclusion of a Peronist on Macri’s ticket could scare away supporters and that Pichetto, who represents Rio Negro province on the northern edge of Patagonia, lacks the political pull to win over many undecided voters.

“The rally looks too far, too fast,” said Frances Hudson, a global strategist at Aberdeen Standard Investments in Edinburgh.

On the economic front, it’s far from a given that the trend of decelerating inflation continues, and a report on Wednesday is likely to confirm Argentina’s deep ongoing recession.

Within hours of the Macri-Pichetto announcement, the rival campaign of Alberto Fernandez and Cristina Fernandez de Kirchner bolstered its team by aligning with opposition lawmaker Sergio Massa. That’s negative for Argentine bonds because it increases the odds of their ticket receiving 40% of the vote in the first round, according to Ezequiel Zambaglione, head of strategy at Balanz Capital in Buenos Aires. Candidates can win outright by reaching that threshold and beating the runner-up by at least 10 percentage points.

“The recent rally offers a good opportunity to reduce positions in Argentina,” Zambaglione wrote in a note to clients on Friday, recommending local currency bonds over dollar debt.

To contact the reporters on this story: Ben Bartenstein in New York at bbartenstei3@bloomberg.net;Sydney Maki in New York at smaki8@bloomberg.net

To contact the editors responsible for this story: Julia Leite at jleite3@bloomberg.net, Philip Sanders

©2019 Bloomberg L.P.