Nov 19, 2018

As Credit Concerns Grow, Short-Term Bond ETFs See Huge Inflows

, Bloomberg News

(Bloomberg) -- As the corporate credit market flashes caution signs, exchange-traded fund investors are seeking shelter in short-term bond funds.

The JPMorgan Ultra-Short Income ETF, known by its ticker JPST, saw its third-largest inflow for the past year on Friday, with more than $233 million coming in. And the SPDR Bloomberg Barclays 1-3 Month T-Bill ETF, or BIL, which tracks short-term U.S. government debt, saw its second-largest cash infusion in at least the last five years. Investors poured around $581 million into BIL on Friday, just shy of its record, which it reached at the end of last month.

That’s not all. The iShares Short Treasury Bond ETF, ticker SHV, attracted more than $673 million on Friday, also its second-largest inflow this year. And the $5.5 billion iShares Short Maturity Bond ETF, or NEAR, saw inflows of around $190 million, the most since July. Together, the four funds took in around $1.5 billion on Friday alone.

“It’s the same trend we have seen for most of the year. Investors are getting out of high yield and investment grade corporate debt and into shorter duration treasuries as the yield curve remains flat,” said Mohit Bajaj, director of exchange-traded funds at WallachBeth Capital. “They are reallocating into less risky instruments with further concern in the market.”

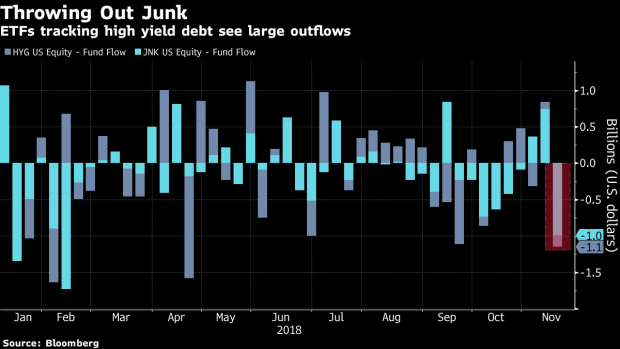

Dumping Junk

At the same time, investors pulled more than $992 million from the $7.6 billion SPDR Bloomberg Barclays High Yield Bond ETF, ticker JNK, for the week ended on Nov. 16. That was the largest weekly outflow for the fund since February. And the $13.6 billion iShares iBoxx High Yield Corporate Bond ETF, or HYG, saw $1.15 billion drain away last week, the most since April.

Christian Fromhertz, chief executive officer of Tribeca Trade Group, echoed that sentiment that investors are seeking less risky funds, saying that “credit spreads are widening” and “people are starting to get concerned about credit risk.”

More investors are growing cautious about the corporate debt market, with heavily debt-laden companies like General Electric Co., Ford Motor Co. and Campbell Soup Co. flashing warning signs as global growth slows and interest rates rise.

Some investors fear that the assumptions built into companies’ profit forecasts could prove wrong, prompting downgrades.

“As single stocks remain under pressure and credit spreads widen, corporate debt ETFs will also sell off with the downward move in equities,” said Bajaj.

--With assistance from Tom Lagerman.

To contact the reporters on this story: Vildana Hajric in New York at vhajric1@bloomberg.net;Carolina Wilson in New York City at cwilson166@bloomberg.net

To contact the editors responsible for this story: Jeremy Herron at jherron8@bloomberg.net, Randall Jensen, Andrew Dunn

©2018 Bloomberg L.P.